Aquaculture pioneers see potential for growing industry in S.D.

Oct. 28, 2019

Mark Luecke is quite sure he was the only South Dakotan in the room for four days this month in eastern India as salmon producers from Norway and Chile mingled with shrimp producers from Ecuador and Vietnam.

The gathering of approximately 500 people was the annual conference of the Global Aquaculture Alliance – a nonprofit formed more than 20 years ago to promote responsible aquaculture practices.

“It’s a cool melting pot of the aquaculture supply chain,” Luecke said. “They have dozens and dozens of counties represented.”

Luecke was there representing one of few South Dakota businesses with direct ties to the aquaculture industry.

His company, Prairie AquaTech of Brookings, sits on the leading edge of an industry dubbed the world’s fastest-growing food-producing sector last year by the United Nations Food and Agriculture Organization.

“Unlike other parts of food production like poultry or pork – they’ve been innovating and tweaking those industries for decades and they’re fairy well fine-tuned – aquaculture is on the front end,” Luecke said.

“So when a new technology get introduced, there’s an order of magnitude difference it makes.”

Tru Shrimp, a Minnesota-based company with its sights set on a $300 million project in Madison, is attempting to achieve one of those industry milestones.

“We changed the rules,” CEO Michael Ziebell said. “The only thing we have in common with the rest of the world is the shrimp itself. Everything else we’ve changed.”

Prairie AquaTech, which formed in 2012 out of research at SDSU, is entering the next stage of its growth.

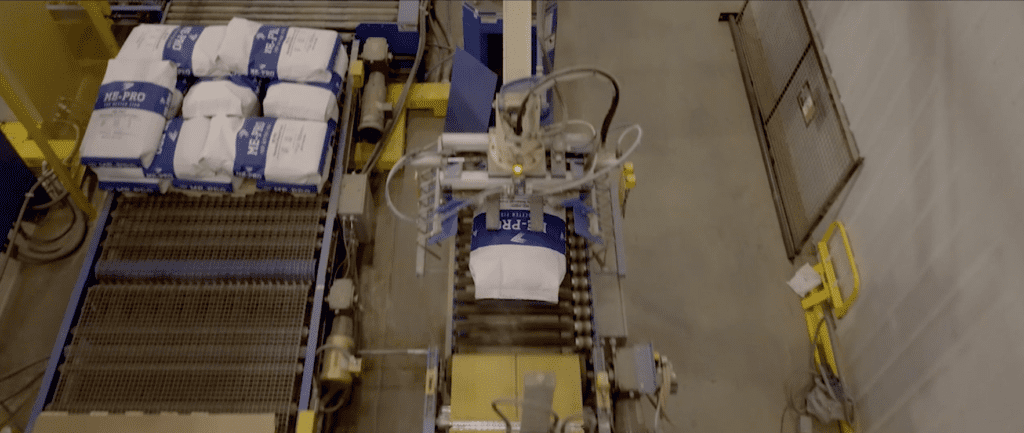

The company uses a natural, biological process to convert soybean meal to a high-quality ingredient fed to fish raised commercially.

This summer, it commissioned a 30,000-square-foot facility five miles west of Brookings in Volga to ramp up production of its protein, which is then sold to feed manufacturers who distribute it to aquaculture producers.

As the conference in India made clear, these two companies are far from the only ones attempting to carve a niche in an industry with a 5.8 percent annual growth rate.

U.S. mega-retailers Costco and Walmart were there too.

“They will tell you what they’re seeing in terms of consumer trends, what people are saying when they come into their stores and on their surveys,” Luecke said. “We all know millennials are looking closer at packaging, but you get to see what consumers are talking about.”

Consumer trends appear to be in aquaculture’s favor. With a world population projected to eat 20 percent more fish by 2030 than it did in 2016, according to the U.N., the industry is positioning itself for expansion worldwide as well as in South Dakota.

But it’s not a clear or easy path.

Regulations vary by state and change even more outside the U.S. A lack of experience or familiarity from banks and investors doesn’t help when it comes to securing private equity or traditional financing.

Startup costs can be high, and the timeline to see a profit can be long.

And then there are the public relations challenges. The Sioux Falls area’s perception of the industry likely took a hit with Global Aquaponics, whose CEO and chief operating officer both received prison time after being convicted of defrauding investors for what was supposed to be an indoor fish farm in Brookings.

But get beyond all that, and you’re left with an industry that seemingly has potential in places such as South Dakota for reasons that make a lot of sense.

“I think we can get into animal production because we’re already there,” Luecke said. “We have people that understand animal husbandry, a growing ag base, we’re the closest to some of the inputs that go into animal production, and we also have a great distribution network to both coasts. We just have to tout those advantages and attract experienced companies and investors.”

Big vision

Tru Shrimp saw enough advantages in South Dakota to pursue a big investment here.

Tru Shrimp’s story has global roots too. Its foundation is in Marshall, Minn.-based Ralco Nutrition, an animal health and nutrition company that has offices worldwide.

In the late 2000s, owners Jon and Brian Knochenmus were visiting Ecuador – a world leader in shrimp pond aquaculture – and found local shrimp farmers were using Ralco products to fight disease in shrimp, with anecdotal evidence they were working.

“They were smitten by it and the potential it had,” president and CEO Michael Ziebell said.

Ralco acquired licensing rights to technology from Texas A&M University in 2014 to grow shrimp indoors in shallow water. The tru Shrimp division of Ralco was formed the following year and began scaling up a tidal basin to validate the technology in a lab.

A pilot production facility – Balaton Bay Reefs – started construction in 2017 in Balaton, Minn., and was commissioned in August 2018.

Ziebell, who spent much of his career in executive leadership at Schwan’s Co., oversees a team of more than 30 and a company with an intriguing, albeit somewhat challenging, story to tell.

“The entire premise of our business is sustainability,” he said. “We are not hurting the environment in any way, where today shrimp farming across the world has many difficulties.”

Tru Shrimp aims to produce “a cleaner, safer, better-tasting alternative,” he continued, while doing so in a facility designed to raise shrimp in what Ziebell calls perfect conditions.

“Forty percent of the shrimp’s diet is soy-based, so we have brought the shrimp to the feed,” he said. “And we’re over 1,000 miles from the ocean, and the ocean is the source of disease for the shrimp. We have no ocean whatsoever. We have to create our own sea water.”

After doing that, the saltwater is reclaimed through an on-site facility and not discharged, he said.

“One of the difficulties we have is people think we’ll be expelling saltwater, and nothing could be further from the truth,” he said. “We have a lot of money invested in saltwater. We don’t want to send it anywhere. We want to keep it, so we built a significant reclamation system.”

Scaling up led the company to Madison late last year after it determined working through regulatory hurdles in Minnesota to add a site in Luverne would put it too far behind schedule.

That’s a tough story to communicate too, and one Ziebell called a painful part of the company’s journey.

“There’s nothing wrong with the people of Luverne. It was just an unfortunate circumstance of events … and we couldn’t risk it,” he said.

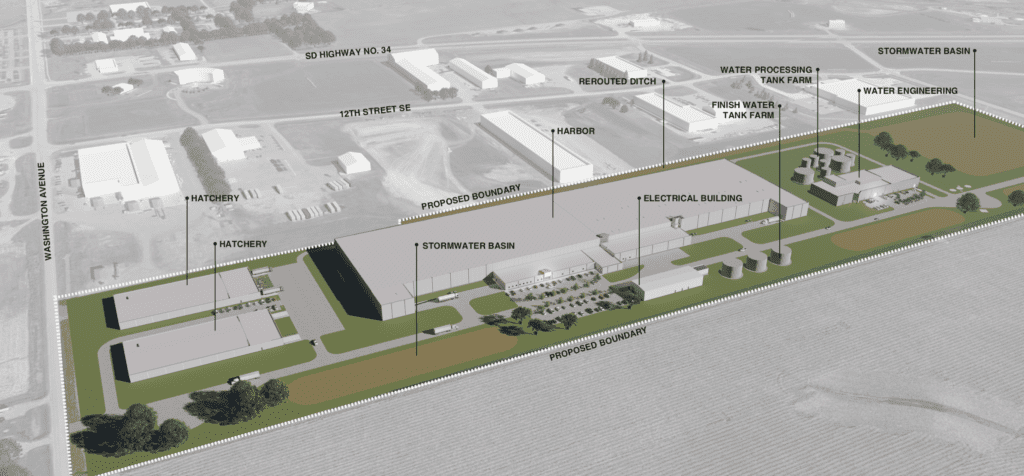

In South Dakota, the hope is to build a $300 million operation in Madison that is estimated to create at least 150 jobs. It would take two years to fully build but be able to start operations about 18 months from breaking ground, Ziebell said.

“We’re very pleased to be coming to South Dakota. We’ve been welcomed with open arms and a great deal of support for what we’re trying to do,” he said. “That’s no small thing.”

Challenges and opportunities

What tru Shrimp is trying to do is nothing less than something that has never been done before.

“It’s a first-of-its-kind,” Ziebell said. “This is all new technology. So in addition to the amount of money (to build it), there’s also the unknowns of doing.”

Aquaculture struggles to get financing anyway, he acknowledged.

“Our difficulty probably revolves more around the fact that all our technology is new. It’s new to the world,” he said. “And with that technology comes great benefits. We’re antibiotic-free, disease-free; there’s the reclamation of the water.”

Tru Shrimp is beginning to seek local investment. It recently held a meeting in Sioux Falls for potential investors and is inviting them to tour the Balaton facility. The hope is to raise $45 million locally to help sustain operations for the next two years and position the company for construction.

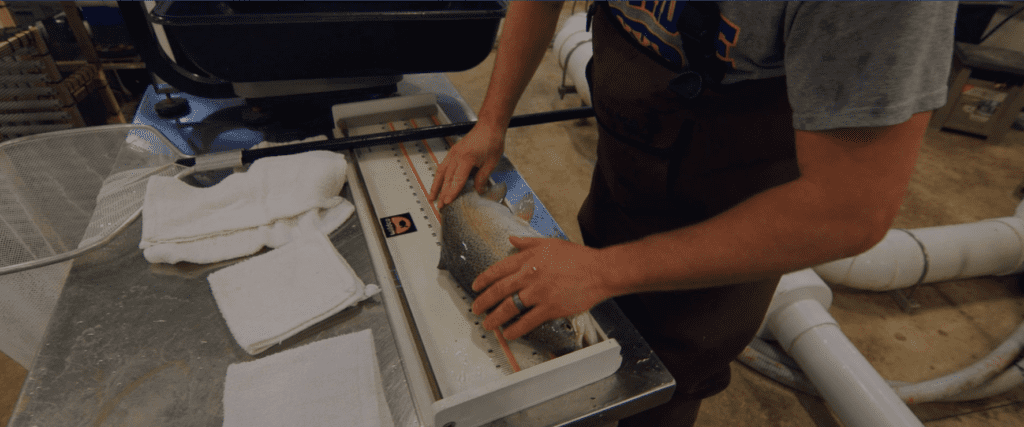

Get to Balaton and the company shows “we’ve done everything we set out to do,” Ziebell said. Four cohorts of shrimp have finished growing in the pilot facility, and the fifth and sixth groups are finishing their growth faster than the first groups.

“So from a scientific perspective, we’re proceeding as planned,” he said. “Even better than planned.”

Restaurants also have started serving the shrimp. Tru Shrimp is working with Minnesota-based The Fish Guys to provide shrimp to high-end seafood restaurants in the upper Midwest.

“They are distributing absolutely everything we can grow,” Ziebell said, adding that the shrimp “have a very sweet, fresh taste unlike anything on the market. The shrimp have never let us down, and because of how we raise them, every shrimp is like the one before. So there is consistency of product, and for chefs … they don’t get to see that.”

Securing financing and investment is a common challenge for aquaculture operations industrywide, said Luecke of Prairie AquaTech.

Operators “have to invest all the capital upfront to build the facilities. They have to stock the facilities and incur a lot of working capital to feed the animals until they get to market weight, and then you have to have sales of the animals. You’ve had to use a lot of your investment to get the point where you can sell your product,” he said. “It becomes hard for an investor or lender to get their arms around that, especially ones who haven’t done it before.”

Many who have done it before are overseas and are more open to making an investment in the U.S., he added.

“We don’t have a large investor base or lending base in the U.S. that has done a lot of these projects … but there have been a lot of land-based salmon production projects announced by European companies in the U.S., and we’re seeing a lot of foreign investment in the U.S. because these are investors and lenders in those countries who understand the space much better than we do and are willing to put production facilities in the U.S. because we have consumers here and they have experience with these types of projects.”

In Prairie AquaTech’s case, financing about $70 million in construction and operating costs wasn’t easy. But it was more doable because the company is considered more of an ag processor than an aquaculture operation.

“We’re very fortunate all our funding really came from within the region,” he said. “We have a lot of people that understand agriculture and understand ag processing, and this allows them a way to understand aquaculture from a different perspective. And we were very fortunate in working with a lender that has worked with other ag processing businesses in South Dakota.”

The deal was structured so investors are paid back after the bank is paid, but timing for that return is still difficult to predict, he said.

“A lot of it depends on the fundamentals of managing a business – good production and sales – so that’s what we’re working tirelessly on now.”

Prairie AquaTech is finding a growing market, though. It has sold or sent samples of its signature product, the feed ingredient ME-PRO, to feed manufacturers in a dozen countries. It has new products in its pipeline that could come to market in 2021.

And it’s already planning for expansion of the plant in Volga. While it has capacity to produce 30,000 tons of ingredients per year, “any one aquaculture feed manufacturer could take 30,000 tons if they wanted, so we might need to expand fairly quickly,” Luecke said.

In Brookings, the pilot facility allows testing for cold and warm water species as well as freshwater and saltwater ones. It’s used by other companies outside of South Dakota to test their new aquaculture products.

While the company is having conversations about expanding other places nationwide or worldwide, “South Dakota has an abundance of good, high-quality soybeans and soybean meal,” Luecke said. “There’s no better place for us than South Dakota.”

Market advantages

South Dakota’s soybean industry is among the key beneficiaries of aquaculture expansion in the state. U.S. farmers’ market share of soybeans in global aquaculture is 33 percent to 34 percent, according to national industry estimates. And that’s without much domestic activity in the space yet.

“It’s predicted to grow huge over the next decade,” said Matt Willard, a farmer from Ethan who has served on the board of the national Soy Aquaculture Alliance for several years.

“We’ve got a large oversupply of soybeans right now with all the trade problems we’re having, so if we can have another source to use that domestically, that would be a home run. In the U.S., we import about 85 percent of all our seafood, so it’s one of the largest trade imbalances. There has to be opportunity to raise more domestically.”

What has happened worldwide in aquaculture has been incredible, he added.

“A lot of countries have grabbed onto the technology, and a lot of that has been developed in the U.S., so it’s just a matter of getting enough entrepreneurs to invest and get the ball rolling,” he said. “Aquaculture has been tried in Indiana and in southern states with catfish, Washington state has some salmon, but lately it’s been South Dakota that’s really been at the forefront with Prairie AquaTech and tru Shrimp. I’m sure rooting for them. I hope it’s a huge success.”

Luecke agreed the state is well positioned to attract additional operations.

“South Dakota is the perfect place for these companies to look for site selection because we’ve got good labor, people who understand animal husbandry, good quality water, a lot of the elements that are important for successful aquaculture operations,” he said. “We simply need that management talent, people who have actually run fish and shrimp farms, to come with the opportunity.”

For his part, Ziebell is reluctant to put a timeline on when tru Shrimp could start construction and shrimp might begin to come out of Madison but said the company is committed to the community.

“I’ve learned not to give dates, but we certainly are hopeful in the next six to nine months everything will be wrapped up,” he said. “Everybody is a bit impatient, but this is a significant amount of money. We have an investment bank assisting us … and we are making progress every day.”