Bender annual Market Outlook predicts post-pandemic momentum

Feb. 18, 2021

A building year that exceeded $900 million in permits, an unprecedented surge in out-of-state relocations and multiple mega-projects might not have seemed like defining events for 2020 most places.

But in Sioux Falls, that’s reality. And it’s reflected in the annual Market Outlook from Bender Commercial Real Estate Services, which reflects some COVID-related challenges but not many.

“If a pandemic couldn’t slow us down, I’m not sure what will,” founder Michael Bender said.

“We’ve just got the right fundamentals. You could see a little bit of retrenchment as a result of the pandemic, but generally speaking if the pandemic couldn’t slow us down in 2020, then I don’t know what will in 2021 or 2022.”

The annual market update was released in video clips on Bender’s website today, in lieu of the traditional in-person event.

“I look for 2021 and beyond to continue to remain very strong economically in our construction and real estate markets,” Bender said.

The big picture

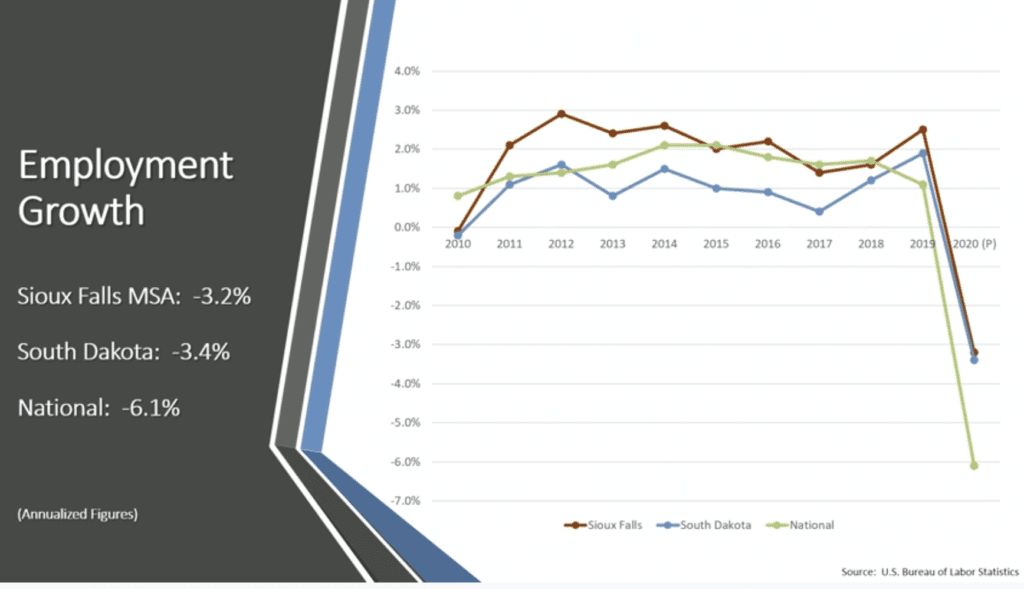

Some key indicators show the resilience of the Sioux Falls economy, while making clear it also has not been immune from effects of the pandemic.

Sioux Falls finished 2020 down 3.2 percent in employment growth. But even that compares with a 6.1 percent drop nationally.

“We added about 10,000 new jobs that we lost in the pandemic,” Bender said. “We’re still short about 5,000 of those jobs, however.”

Fewer people also were looking for jobs at the end of the year.

“That’s not surprising, however, but it shows the resiliency of the Sioux Falls economy,” Bender said.

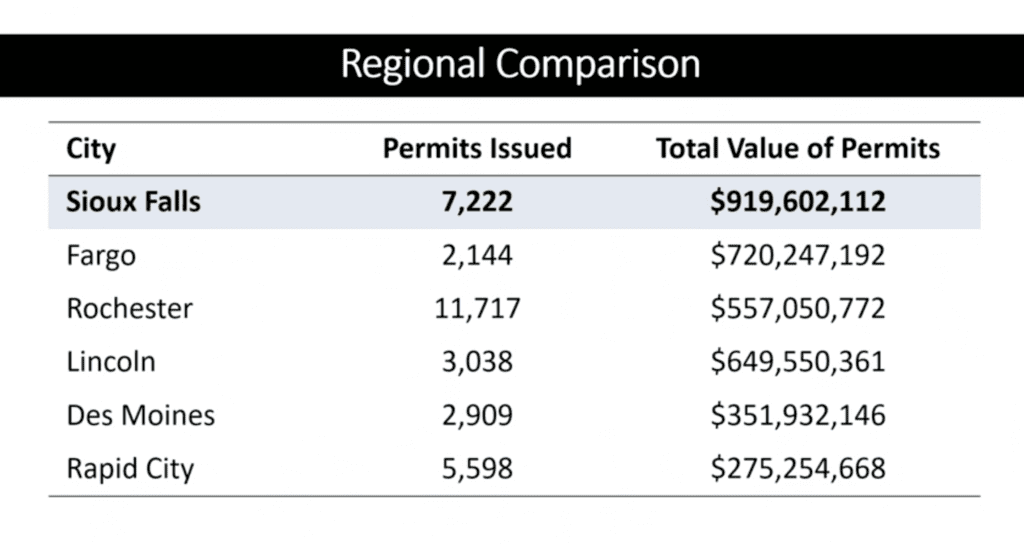

The city’s record $919 building permit year included about $200 million for an Amazon fulfillment center. But, even so, look how it compares to surrounding communities.

“Look at what we did with fewer population base, and yet we have a greater value of construction than they have,” Bender said.

Industrial surge

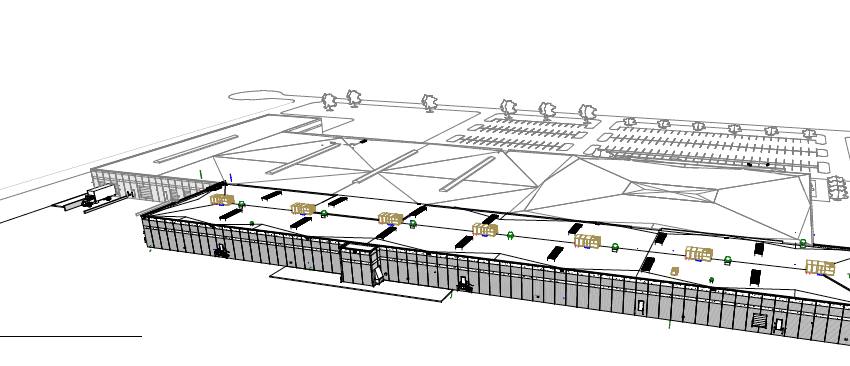

Amazon and others in the industrial market are combining for a significant uptick. The Sioux Falls area currently counts 24.6 million square feet of industrial space.

“I think over the next two to three years, that number is going to supersede 30 million square feet,” said Bender partner Rob Fagnan.

“You don’t have to look any further than Foundation Park.”

A national developer is looking to build on 56 acres and put up a 500,000- to 750,000-square-foot building, Fagnan said.

Win Chill just received a permit for its third expansion, an additional 130,000 square feet.

And, in addition to Amazon, CJ Foods has announced plans for an estimated $500 million Asian food production facility in the next several years.

“These are major projects within our market, and not only are they major projects within our market, they would be huge projects in Minneapolis, Des Moines or Omaha,” Fagnan said. “New construction is going to skyrocket.”

There’s also significant activity in Tea, Brandon and Harrisburg, especially Tea’s Bakker Landing development.

“The availability of land out in this development has created a lot of small-business opportunities to come out there and buy small chunks of ground,” Fagnan said. “Additionally, the visibility from the interstate is a huge bonus and so is accessibility to the interstate.”

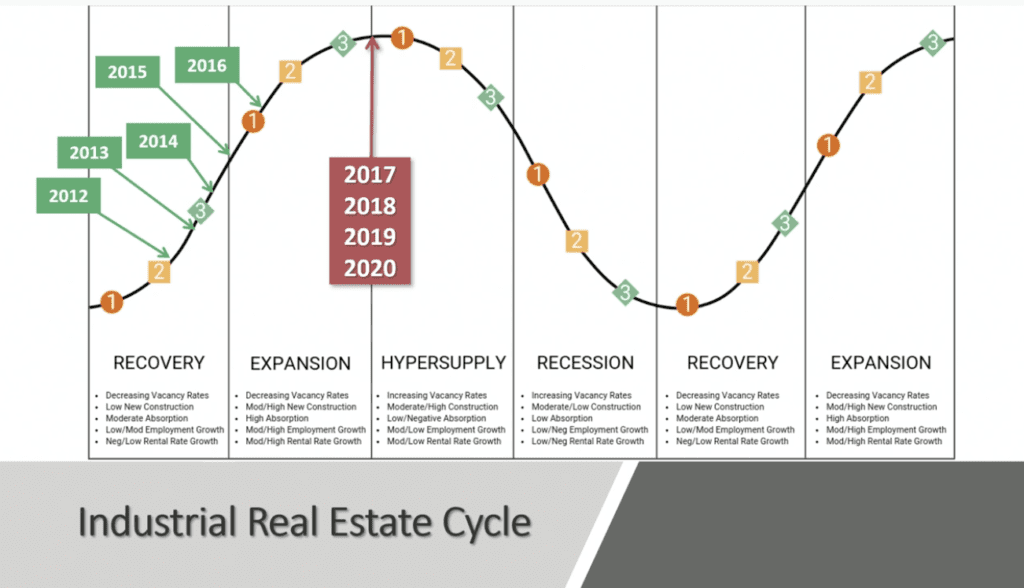

Traditionally, the market has added about 500,000 square feet of industrial space annually.

“And now we’re adding millions of square feet into the market,” Fagnan said. ”What we’ve seen over the last couple years is perpetual expansion, and that’s where we’re headed for the next couple years.”

Vacancy is steady at about 4 percent. Fagnan estimates that with all the property activity, 15 percent to 20 percent of the overall industrial market locally will be added in the next few years.

“Companies such as Amazon and CJ Foods are overshadowing other major projects,” he added.

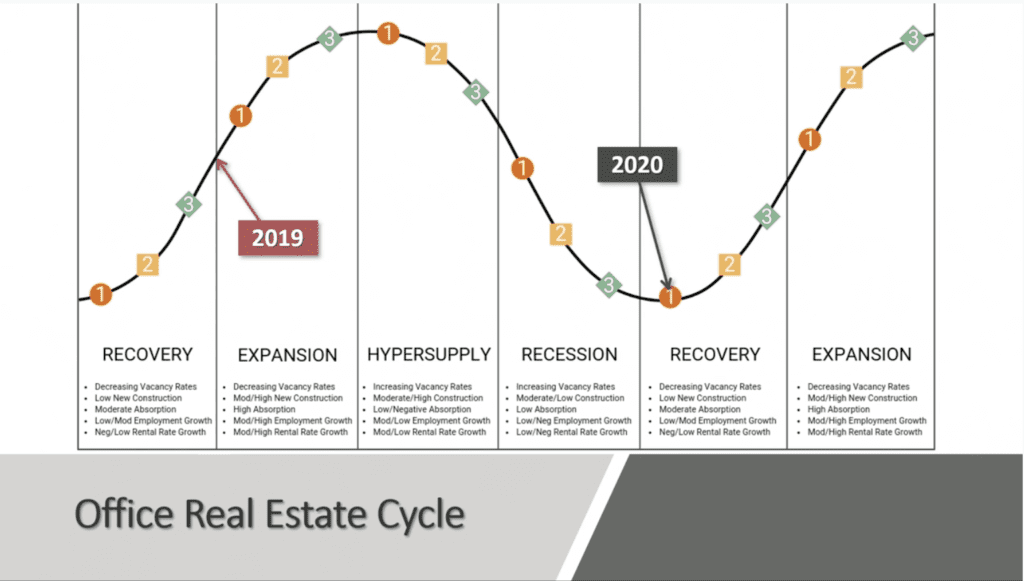

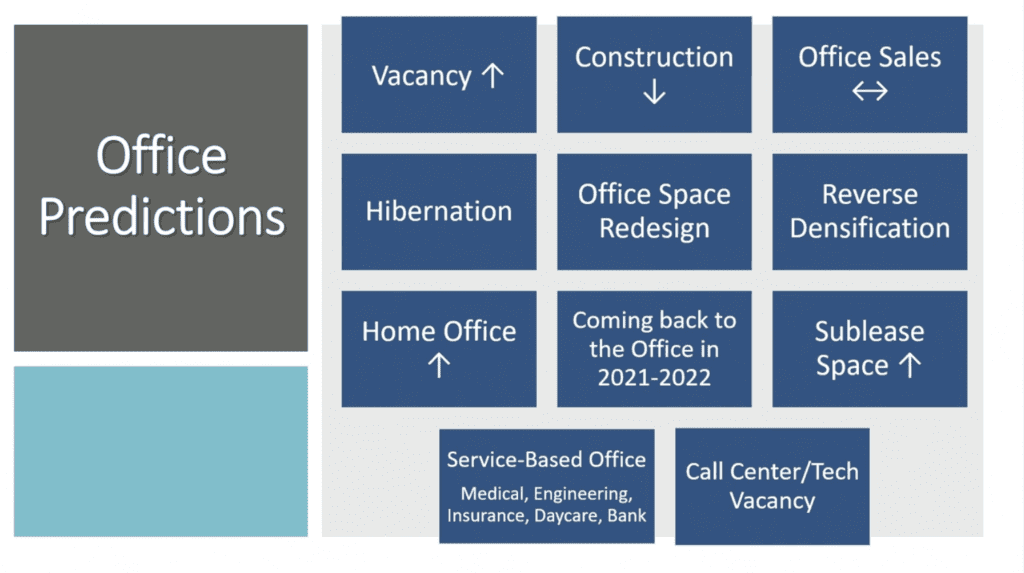

Office shakeup

The office market worldwide “was rocked” in 2020, “but Sioux Falls showed some resiliency,” said Bender partner Reggie Kuipers.

As mass numbers of workers shifted to working from home, the question now revolves around how many will come back to traditional offices and what those offices will look like when they do.

“It’s estimated 57 percent of financial services employees can probably work from home,” Kuipers said. “That’s going to lead to some problems and some issues.”

Citywide, office vacancy ended 2020 at 9.9. percent – exactly the same as the prior year.

“That was shocking to us,” Kuipers said.

Downtown is tighter, especially for Class A, or the most upscale space. It’s at 2.2 percent.

“It’s probably time for us to see a multitenant, multistory office building downtown,” Kuipers said.

“I look for continued expansion and gentrification of office space, especially on the East Bank, in the next couple years.”

Suburban office space is at 5.5 percent vacancy for Class A.

Independent medical offices, banking, engineering, insurance and day cares drove office use in the past year, Kuipers said.

The big question is how many currently empty office buildings bring workers back.

“These tenants or owners are still paying rent and mortgages,” he said. “It remains to be seen what happens as we shift and come back to the office in 2021 how much of this space is left.”

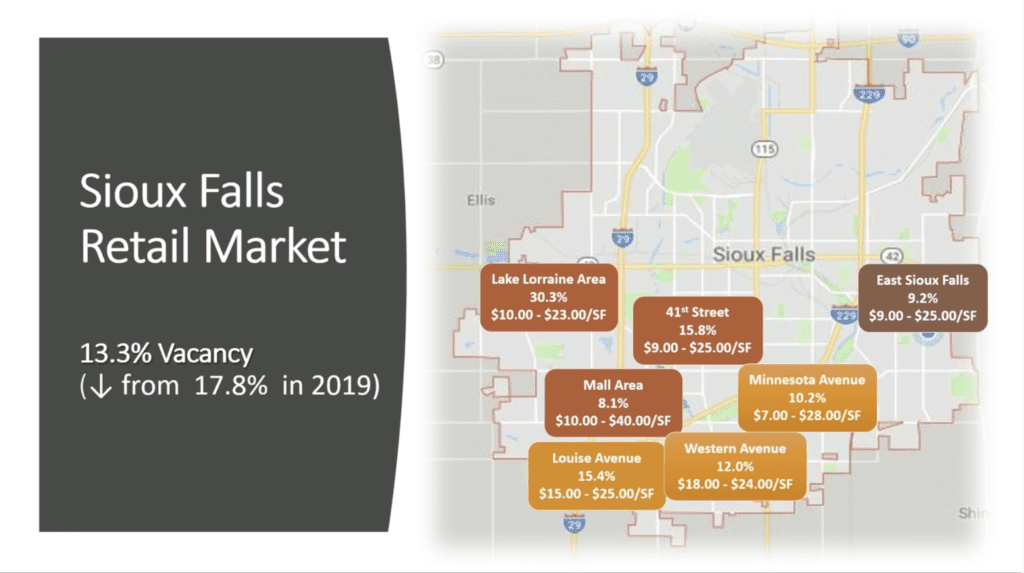

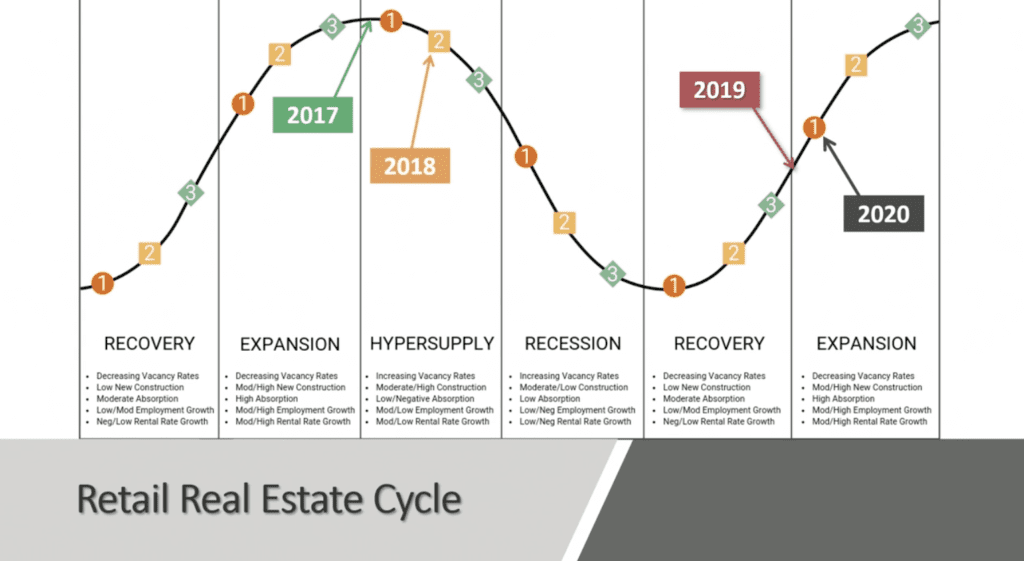

Retail winners and losers

The state of retail largely depends on the segment, Bender commercial broker Rob Kurtenbach said.

The winners of 2020 included retailers that could meet strong demand for food, home furnishings, home improvement and alcohol.

“Generally speaking, most Sioux Falls retailers had a great year in 2020,” Kurtenbach said.

Those that struggled, locally and beyond, included dine-in-only restaurants, travel and hospitality, movie theaters and experiential retailers.

“We saw that locally as the new construction of Dave & Buster’s was put on hold, and time will tell when that will resume,” Kurtenbach said.

The area around The Empire Mall continued to attract new national retail in 2020, including Chipotle and Chick-fil-A, and mall owner Simon recently co-listed the former Sears space with Bender.

Its potential uses include health care or office space.

“Historically, malls are accustomed to controlling the tenant flow and backfilling vacant spaces on their own,” Kurtenbach said, while adding The Empire “still remains the retail center of Sioux Falls.”

The area around the mall has limited availability, with about 8 percent vacancy. Citywide, that number is 13.8 percent in the retail sector, down from 17.8 percent a year ago.

Larger east-side spaces have filled, with tenants such as Vern Eide Motorcars, Runnings and Builder’s Millwork & Window.

“However, keep in mind retailers typically have to sign long-term leases, so the true impact of COVID for many has yet to be seen.”

Kurtenbach predicts vacancy will continue to increase and new construction will be steady.

“We’re going to continue to sit in expansion,” he said, pointing to not just the mall area but also the former Gage Brothers site on West 12th Street and the Sioux Steel redevelopment downtown as opportunities.

“Sioux Falls is well positioned in the retail sector for 2021 and beyond.”

Bender’s annual report also covers land and investment markets. To view presentations on all sectors, click here.