Berkshire Hathaway annual meeting provides insight into investments, industries

May 30, 2018

John Barker attended the annual meeting of Berkshire Hathaway on May 5 in Omaha and provided the following recap.

By John Barker, CFA, Elgethun Capital Management Inc.

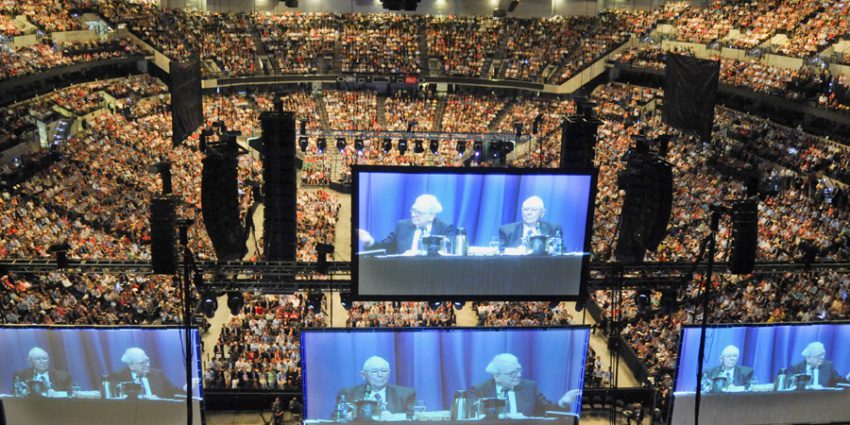

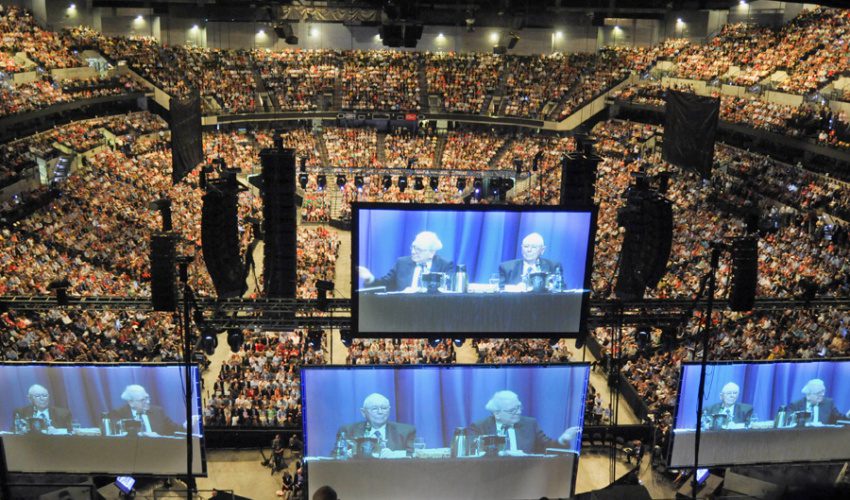

If you haven’t attended a Berkshire Hathaway annual meeting, it’s difficult to explain the scene, which is unlike any annual meeting. Over 30,000 investors fill the CenturyLink Arena to hear Warren Buffett and his partner, Charlie Munger, answer questions from shareholders, analysts and journalists. Buffett, 87, and Munger, 94, sit on stage for six hours and answer questions while eating See’s peanut brittle and chocolate and drinking Buffett’s favorite beverage – Cherry Coke. Below is a quick synopsis of my main takeaways from the 2018 meeting, in no particular order.

General investment advice

Buffett opened the meeting with a discussion on the proper perspective on investing and his long-term optimism in America’s future. A $10,000 investment in 1942 in a broad-based American stock index fund would be worth over $51 million today. The same investment in 300 ounces of gold at the 1942 price would be worth about $400,000. Investing in America’s businesses would be worth more than 100 times the gold investment. All the wars, recessions, political problems and worries couldn’t derail the inevitable – America’s structured, free capitalism system works. Buffett always comes off as an eternal optimist, but I believe he’s right to believe America’s success will continue. Some argue “that was then and this is now” while listing our current concerns.

It seems the majority of people believe the future won’t be as prosperous as the past, but this thinking is psychologically motivated. For generations, people have believed the future would be worse than the past, but America keeps making progress, raising the standard of living and innovating. In reading history, it’s obvious – we have always been concerned with the future, and this concern has led many prognosticators to believe the current generation is presiding over the last great American generation. But think about this question: If you could pick a time and place in history to be born, when and where would you select? For more on this topic, I would suggest you read Steven Pinker’s new book, “Enlightenment Now,” specifically, chapters four and five.

Specific investment advice

Wells Fargo: Buffett and Munger believe Wells Fargo is well positioned to not only recover from the infinite regulatory infractions but also thrive again.

Chinese investments: Munger owns a lot of Chinese equities and believes China is a “better hunting ground” compared to U.S. markets. Berkshire continues to own 10 percent of BYD, a Chinese battery manufacturer.

Buffet on tech investing: “Tech or not, we base our decisions on the durability of competitive advantage and if we think we are better at assessing the probability of improving the durability. Amazon doing what it did, I thought would be something close to a miracle, and I tend not to bet when I think something takes a miracle. I would’ve been far better if I had insights.”

Buffet on Apple: “We went into Apple because of the intelligence of the capital deployed and the value of the ecosystem. It didn’t require me taking apart the iPhone and figuring out the components to see what Apple had. It was more the nature of consumer behavior. We miss a lot of things we don’t understand well enough. But there’s no penalty for not swinging at something … stay in your circle of competence where you might have an edge because of experience or reason.”

Munger on missing Google: “I’ve been to the Google headquarters. It looks like a kindergarten, a very rich kindergarten. The mystery was what competition would come along? Would it be four or five players slugging it out or one dominant player?”

Munger on Jeff Bezos: “We underestimated Jeff. We had a very high opinion and still underestimated him.”

Politics

An investor asked a question related to politics: “Are political divides worse now than ever?”

Buffett: “There have been multiple times in my life where we were more divided than ever, it felt. We’ve gone through periods where people I knew and admired said that there would never be another election because the other party was in power. I’ve heard and seen a lot. Since 1942, there’ve been 14 presidents – seven Republicans and seven Democrats. One was assassinated, and one resigned under pressure. We had recessions and panics and wars and crises, and through it all America really moved ahead. Think about this country: in less than three of my lifetimes (263 years), back to when (Thomas) Jefferson was 12 and there was nothing here — you’ve flown in from all over and flew over all these occupied homes and medical systems and universities. The country really, really works, and we always will have lots of disagreements and will have people saying the world is ending after every election. I’ve seen a lot, but the country has seen sixfold per capita GDP growth. Everyone here has a multiple better standard of living than John D. Rockefeller. This is a remarkable country. I would love to be a baby being born.”

Munger: “There’s a tendency to think present politicians are much worse than past, but we tend to forget how awful they were in past. I can remember a prominent senator from Nebraska arguing how mediocre people should have no representation in Senate.” Buffett: “He succeeded my dad in the House!”

Trade and tariffs

Buffett doesn’t believe we’ll see long-term damage from a trade war between China and the U.S. because both countries need each other and both have benefited from trade. Buffett on trade: “The benefits are huge, and the world depends on trade for progress. Both countries have done remarkably well with trade, and the only problem is when one side wants to win a little too much. But we won’t sacrifice world prosperity for differences that arise on trade.”

Munger: “Both countries are advancing, and China is faster. It came from a lower base and has more virtue with its high savings rate. And it was mired in poverty for a long time, so it will grow faster. Both countries are getting along fine, and both will realize the last thing they should have is ill will for the other.”

Munger also discussed how terribly adverse steel conditions have been to U.S. manufacturers.

Health care

Amazon, Berkshire and JPMorgan Chase started a health care initiative in 2017 aimed at lowering costs and creating a better model. They plan to start with the combined 1 million employees among the three firms. Buffett didn’t detail a particular strategy, but a new CEO will lead the entity, and he’s optimistic they can chip away at what he calls “the tapeworm of American business.” Currently, health care costs make up 18 percent of GDP, and these costs are growing faster than inflation. Munger: “The U.S. will have a single-payer health care system when the Democrats take office again.”

Cryptocurrency

Buffett: “Nonproductive assets remain that way. Gold at the time of Christ to now has a compound rate of a couple tenths of percent. These assets won’t deliver anything other than supposed scarcity, but so what, what does it produce itself? This is counting on someone else later on trying to buy a nonproductive asset because they can sell it for a higher price. You go based on what an asset will produce versus hoping tomorrow morning the price will be higher, and you need more people coming than going. And it can feed on itself for a while, but cryptocurrencies will come to bad endings. There are a lot of charlatans who are just trying to create things. People of less than stellar character see an opportunity to get rich because their neighbor is, and neither understands it.”

Munger: “I like cryptocurrencies a lot less than you do. To me, it’s just dementia. It’s like somebody else is trading turds and you decide you can’t be left out.” Buffett: “To the extent we are being broadcast around the world, I hope that your comment doesn’t translate!”

Valuations/holding cash

Berkshire currently has $312 billion in cash, stocks and short-term investments with cash representing 35 percent, or $109 billion. Berkshire keeps at least $20 billion in cash for operating reserves, indicating about $90 billion is available for acquisitions/stock purchases. Some investors are frustrated with Berkshire for holding so much cash and not returning it to shareholders, but this seems counter intuitive. Berkshire puts cash to work when attractive investment criteria is achieved. and this patience has been rewarded bountifully in the past.

Overhead

This is truly an amazing statistic: Berkshire has 30 people working at corporate headquarters. That number is low for any public company, but for a $500 billion market cap company, it’s insanely low. In fact, Berkshire doesn’t have the following departments: public relations, investor relations, financial planning and analysis, M&A and strategy. Munger: “Bureaucracy is sort of like cancer and functions like one.”

Berkshire, post-Buffett

Strangely, there was little discussion about Berkshire promoting Ajit Jain and Greg Abel to vice chairmen of the board. The Berkshire structure post-Buffett is clearly in place with Jain overseeing insurance, Abel overseeing noninsurance businesses, Todd Combs and Ted Weschler overseeing investments and capital allocation, and Buffett son’s Howard as nonexecutive chairman of the board. The one open question: Who will be CEO? This will depend on how long Buffett continues. Jain may be favored, but he’s 66, and if Buffett continues for five or 10 more years, Jain may be too old.