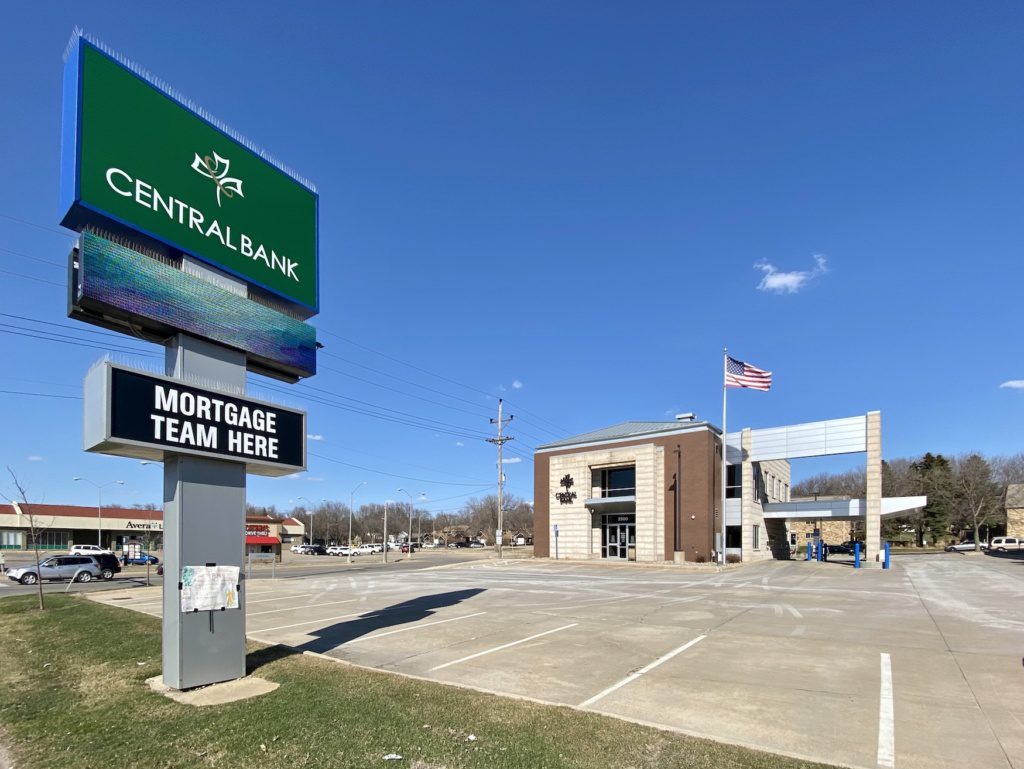

Central Bank enters Sioux Falls market with strong commitment to helping customers through uncertain times

April 8, 2020

This paid piece is sponsored by Central Bank.

The name has changed, but the commitment to helping customers navigate their financial lives has never been stronger.

MetaBank’s community banks became part of Central Bank in March; and while the signs have switched, the same veteran team is in place to help serve individual and business customers through the COVID-19 pandemic and beyond.

“We took proactive steps early on to keep our customers and employees safe, and help combat the spread of the virus,” said Kathy Thorson, market president.

“The steps have put us in a position to best serve our clients no matter how disruptive things become, and our customers have responded well. They have been very understanding and share our belief that we’re all in this together.”

Supporting businesses

Central also has spread out its business bankers at locations across Sioux Falls as a precautionary measure.

“Our business bankers are putting in some very long days, but they’re very attentive,” Thorson said. “They realize we have a short window to accommodate business customers, and we know they are anxious to gain access to the SBA programs and funds available under the CARES Act.”

All business customers will have a dedicated loan officer with extended service hours and digital resources to serve their needs. To support that loan officer, Central has a devoted task force working behind the scenes to accelerate turnaround times and provide CARES Act and regulatory expertise.

“Now is the time to leverage your relationship with your bank,” Thorson said. “When I talk to business owners, I remind them to bring their banker, attorney and accountant together during times like this. Let them help you work through your challenges.”

Central also has automated processing tasks as much as possible to eliminate duplicated steps and expedite customers’ needs.

“As an SBA Expressed Lender, Central Bank has the authority to make decisions on SBA-eligible loans to expedite funding,” Thorson added.

“We know there’s concern. In some cases, owners have spent decades building their businesses. It’s a case-by-case situation, so we just encourage them to reach out and talk to their bankers. We are hopeful that because of the historic stability of our local economy, many businesses are entering this time of uncertainty from a position of strength. However, we know there are things happening beyond their control, and we are here to help as much as we possibly can.”

Branch changes

Within the Central branches, customers will find some changes.

Lobby access is limited to appointments only, and drive-up hours have been adjusted.

Tellers, personal bankers and branch managers have staggered their work schedule, rotating two weeks in the bank and then two weeks at home or vice versa.

“We’ve invested in additional technology to allow high-risk and key employees to work remotely,” Thorson said. “We’re doing all we can to make sure people are staying well. And, if employees were to become ill, we have healthy team members who have been home and well, and can come back.”

Customers also have many ways to manage their accounts without leaving home:

- Access your accounts using Online Banking.

- Sign up for text alerts through Online Banking.

- Use the Online Banking chat service.

- Use Mobile Banking for quick and easy access to your accounts.

- Deposit checks using Mobile Deposit.

- Make payments using Bill Pay.

- Open a checking account online.

- Apply for a mortgage online.

- Call Bankline 24/7, the telephone banking system.

Central has reached out to less tech-savvy customers individually to remind them banking help is still just a phone call away.

Individuals also can reach out to the bank if they are experiencing financial difficulties.

“We understand these are trying times,” Thorson said. “If you are struggling, we may have options for you.”

Giving back

Central Bank recently donated $55,000 to support food charities in the communities it serves, including $5,000 to Meal on Wheels in Sioux Falls.

“The impact the coronavirus has on local families is concerning. It’s been weighing heavily on our minds,” said Central Bank CFO and president John Brown.

“We felt we had to do something substantial to assist with the ongoing availability of emergency food and supplies.”

Caring for your neighbor “is even more crucial during times like this,” added Central Bank CEO and chairman of the board Tim Brown.

For Central, which has been a family-owned bank chartered in Storm Lake, Iowa, since 1877, it’s part of a centuries-old culture.

“At Central Bank, we feel it’s important to step up, help out and provide support where it’s needed,” Tim Brown said. “Our local food charities are on the front lines and offer an essential community service.”

Central Bank’s locations in Sioux Falls and beyond are here to serve you. Please reach out to any branch, and you’ll receive the help you need. Member FDIC.