Fueled by fintech success, local banking business hits growth spurt

March 21, 2021

Think of it as a bank account of sorts for your March Madness bracket.

Or a savings fund for your fantasy football wagers.

Tom Mangan and Alex Cullingford have built an app for that.

It’s called DraftFuel – an idea that came to Mangan a few summers ago while on a beach in New Jersey as a friend contemplated placing a bet on an upcoming UFC fight.

His wife wasn’t for it.

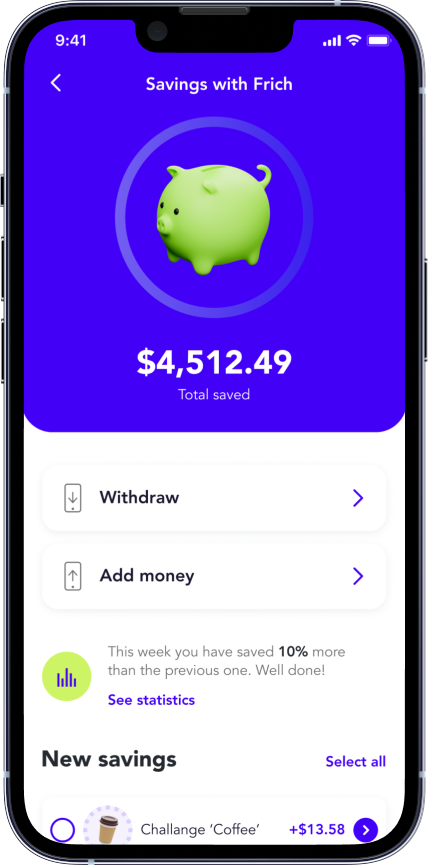

“It automatically clicked,” said Mangan, now CEO of the startup. “Spare change goes into a ‘piggy bank’ for (my friend) Bob to gamble to his heart’s content. That’s where the light bulb went off for me.”

When vacation ended, he took the idea to friend and former mortgage banking colleague Cullingford, a lifelong fantasy sports fan.

Alex Cullingford and Tom Mangan

“The idea of being able to use what people would perceive as found money really appealed to me,” Cullingford said. “You’re removing that fear of losing money.”

In most scenarios, the fledgling fintech company would have started building and continued to grow from its home base on the East Coast.

But thanks to a unique accelerator program, this startup – and about 20 others – have a story that now winds through Sioux Falls and the growing financial services business Central Payments.

“I think we’re more top of mind than what we would have been a couple years ago,” said Trent Sorbe, who founded Central Payments in 2014.

That might be a bit of an understatement.

Central Payments settled more than $2 billion in transactions last year, putting it 17th nationwide in terms of issuing volume, Sorbe said.

“We’re the fastest growing year over year, so I continue to see our growth in that 50 to 75 percent range year over year. You can pretty much bet on it,” he said.

That has led the company to double in size in a few years, with a team of 70 people and a growing office presence in downtown Sioux Falls. Central Payments gradually has taken over some space vacated by Experity, the former DocuTap, in The Plaza on Phillips Avenue and Ninth Street.

“I think that’s a function of us building out more technology, cloud-based technology that allows companies to integrate with us to offer payments anywhere in the world. So I think we made ourselves more suitable in the marketplace,” Sorbe said.

The pandemic has bolstered the electronic payments industry, he continued, as people moved away from paying by cash and checks to more contactless, digital approaches.

“It’s one of the few industries that didn’t suffer any real COVID impact,” Sorbe said. “That allowed us to grow.”

Sorbe is president of Central Payments, which is a division of Central Bank of Kansas City, a 70-year-old family-owned bank. The inventor on 14 patents related to consumer financial services lives in Brookings and established the initial office in Dell Rapids, so it was halfway between his home and Sioux Falls.

“I’m kind of a small-town guy,” he said. “And none of our business is local. We’re doing Zoom calls with folks in the Ukraine or South America, the U.K., from Dell Rapids.”

The company “sort of came up with the fintech wave” that began nearly a decade ago, he said, and benefits from a cloud-based platform.

“We are more vertically integrated,” he said. “We’re able to do more than what historically card issuers are able to do.”

Falls Fintech success

A unique and important part of the company’s growth strategy began nearly exactly when the pandemic did.

Falls Fintech is an incubator geared toward accelerating market readiness of early-stage financial technology companies that could become users of Central’s products.

In March 2020, the first companies had been selected, and founders came to Sioux Falls from as far as Manhattan; Los Angeles; Washington, D.C.; and Salt Lake City. The plan was to spend three months here.

Instead, they arrived on a Sunday and had to be sent home by Wednesday.

“I was feeling sorry for myself,” acknowledged Nikkee Rhody, executive vice president of strategy for Central and managing director of Falls Fintech. “It was tragic. The whole thing was ripped out.”

But it wasn’t over. The program went virtual; and now, two years later, it’s on its fourth cohort, and 20 companies have completed the accelerator.

“We have an 85 percent success rate of startups still viable and raising funds, and five companies are in the implementation cycle,” Rhody said. “When you look at the fintech boom, you have really smart people sitting in the garage going, ‘We could use technology and do a cool thing.’ Venmo, PayPal, there are cool ideas to move money from point A to point B, and the next big thing might be cooking right now.”

The idea is to “get these early-stage fintechs in, teach them, equip them, get them bank-ready and then connect them to our API ecosystem, and then Central Payments continues to stand them up and get them in market,” Rhody said.

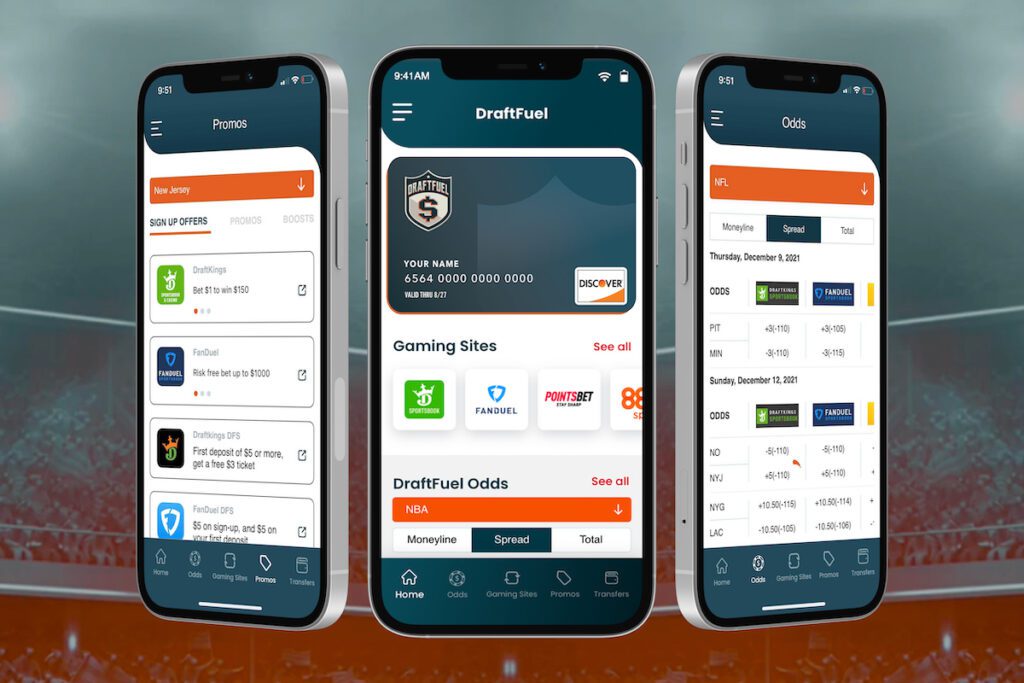

That has been the experience for DraftFuel, which now has an app that integrates with a user’s checking account to round up transactions and place the spare change in the DraftFuel account to be used in sports betting.

It expects to be live on app stores soon, and the founders credit Falls Fintech for helping get them to that point.

“As outsiders in the industry, we needed that crash course, and they provided exactly what we needed,” Cullingford said. “It was amazing. We’re from Philadelphia, so it was great to see somewhere different, especially coming off COVID.”

For a year, “we would pick up the phone and call a spreadsheet of banks asking if they had a program they could offer us as a startup, and we were turned away left and right,” Mangan said. “So to be welcomed with open arms and have someone dig in and work hand in hand with us was fantastic. We learned so much about fintech, banking regulations and compliance.”

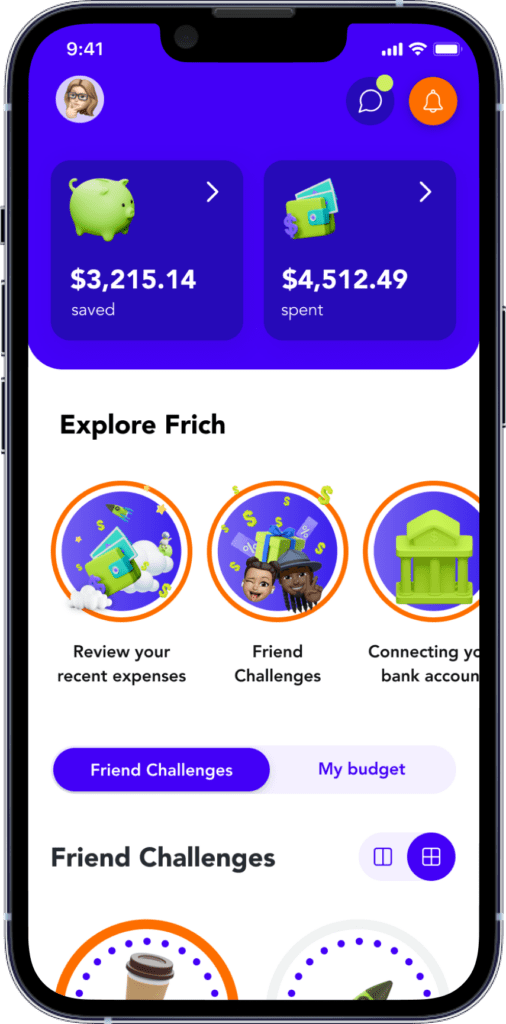

Frich co-founders Katrin Kaurov and Aleksandra Medina had a similar experience with their business, which is a social finance app designed to help Gen Z develop better spending habits.

The friends and former New York University classmates reconnected in New York City during the pandemic, and “we realized it was a good time to make something new,” Kaurov said.

Aleksandra Medina and Katrin Kaurov

Kaurov majored in innovation and entrepreneurship, while Medina studied interactive media in a combination of engineering and design. Together, they identified a problem they thought fintech could solve.

“We’re just always broke,” Medina said. “Always overspending beyond our limits, allowing our social life to take priority over good financial goals.”

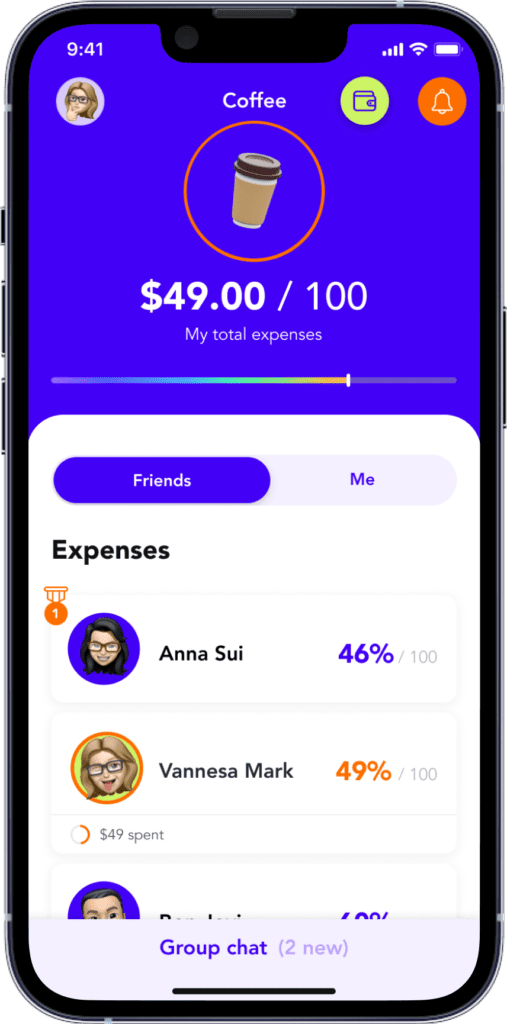

It led them to develop Frich, which they patterned somewhat after fitness apps. Not only does it allow users to create and track budgets for various aspects of their lives, but also it shows friends one another’s progress.

It doesn’t show dollar amounts but percentages, so “if I see Katrin is doing really well, I’m going to hold myself back and do well,” Medina said. “And if I see Katrin has spent 80 percent of her budget, I’m not going to go invite her to the nicest restaurant in town. I might invite her over, and I’ll cook or we’ll go for a walk.”

They began onboarding users at universities last fall and are nearly at 15,000. Revenue is generated through brand partnerships and a potential subscription-based model.

The team won an annual NYU-Yale pitch event last year and has a strategic partnership with MasterCard.

Participating in Falls Fintech was “the most useful thing we’ve done in our lives,” Kaurov said. “It was a 12-week, intense crash course.”

Once participants go through the program, “they’ve got their bank deal,” Sorbe added. “Falls Fintech for us is how we attack the fintech vertical, and it certainly has exceeded expectations and filled Central Payments up more than we expected.”

The program currently brings the companies to Sioux Falls for the first and last week, but the vision is still “that we will get to a place where we can get three months of solid work together,” Rhody said.

For some, though, the move might be even longer. One participant from Manhattan already is interested in relocating to the area.

“I am 100 percent convinced these companies are going to start relocating to Sioux Falls,” Sorbe said. “If we hadn’t had COVID, I would have bet four or five would have made Sioux Falls home … and I still think in a post-COVID world I continue to believe we’re going to see more and more companies come here. They’re always surprised.”

And the city, as Central Payments has found, can support the fintech industry with talent, he said.

It started with Citibank, evolved to include companies such as Total Card, Bancorp and Meta Financial Group, and now is evolving further into fintech, Sorbe said.

“Sioux Falls has been able to adapt and continue to morph itself to keep up with the way fintech and payments and banking are happening,” he said. “We’re able to bring talent in. We’re able to recruit successfully locally. We can post for an anti-money-laundering compliance person and get plenty of resumes because that’s a role played in a lot of organizations. Where if we were in Omaha or Minneapolis, that’s a much tougher ask.”