Health insurance for 2019: Compare plans; know what you’re buying

Nov. 26, 2018

This paid piece is sponsored by Avera.

The end of the year means it’s also health insurance time. Most company plans are up for re-enrollment this time of year, and if you’re a one-person business, you must enroll during the set open enrollment period for individual plans Nov. 1 through Dec. 15.

Here are the important things to know about health insurance this year.

Price

Small business: Small-business owners can change plans or set up new coverage anytime of year – there is no set open enrollment period like there is with the individual market. But this year is a great time for small businesses, with two to 50 employees, to compare plans and save money.

At Avera Health Plans, for instance, small businesses could save up to 30 percent this year.

“Look for value,” said Debra Muller, CEO of Avera Health Plans. “You pay a lot for health insurance coverage. We know that it is a terribly competitive workforce right now, and being competitive means providing health insurance as a benefit. But it shouldn’t be health insurance at any cost as you’ll also need to direct dollars toward other benefits and salary increases.”

Individual: Prices have stabilized for the first time in years on the individual market as the risk pool has stabilized, Muller said. In addition, no congressional or administrative changes have occurred recently to cause worry among carriers for 2019.

“That’s a good thing, and that’s why we’ve been able to take a new look at all of our plans and strive for the most competitive pricing. Most carriers have done this. It’s not just happening at Avera or in Sioux Falls.”

ACA is still a thing

The Affordable Care Act is still in effect, although there have been some changes to it. That means that ACA requirements are still in place for all policies that insurance carriers offer. This is true for both small-business and individual plans. All ACA policies will offer 10 essential health benefits, such as coverage for pregnancy, hospitalization and preventive care.

Know what you’re buying

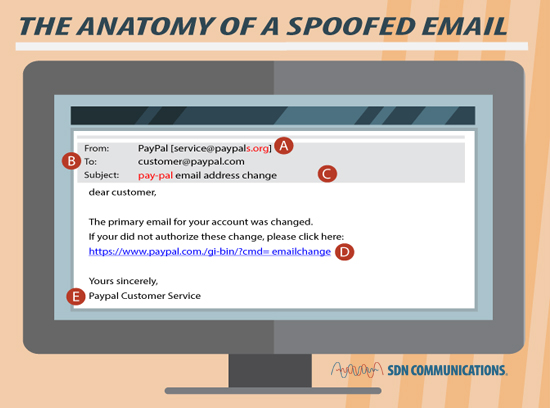

One major ACA change is that people no longer are fined for not having insurance beginning in 2019. That has opened the door wider for what are known as membership programs. These programs are not health insurance, Muller explained. They charge a monthly membership fee, and if you have a medical expense, you can request assistance or cost sharing. People who buy these memberships are considered uninsured or self-pay, and health care organizations typically do not file health insurance claims to these organizations because they are not health insurance.

“People who buy these memberships are still uninsured, and they are still solely responsible for their health care bills. They may receive assistance from the membership program to pay their bills, but there are no guarantees of coverage,” Muller said. “You have no protection you can depend on if you have a chronic condition or catastrophic health event. That’s why we strongly urge people to make sure they’re getting an insurance product through a carrier that is licensed through the state of South Dakota.”

Consider an agent

An agent will make sure you’re getting a legitimate plan that fits your needs, whether it’s for a small business or individual plan. Another option is to call the South Dakota Division of Insurance and make sure the plan you’re considering is licensed by the state.

“Working with a licensed agent is to your benefit,” Muller said. “They know what is health insurance and what is not health insurance, and it’s extremely important to have that information when both your finances and your health are at stake.”