Investor and developer alert! Sioux Falls O-zones offer big tax incentives

Dec. 12, 2018

This paid piece is sponsored by Eide Bailly LLP.

By Blake Crow, CPA, tax partner, and Kassie Hoiland, tax senior associate

Following in the footsteps of Yanny or Laurel, the Super Bowl selfie kid, and that annoying baby shark song, I’m predicting that 1400Z-2 will be the next thing to go viral this year. This cool code section created by the Tax Cuts and Jobs Act is designed to encourage investments in low-income communities by offering impressive tax incentives. And you might be surprised to learn significant areas in Sioux Falls may be eligible for these lucrative tax breaks.

Walk through this scenario with me so I can explain why learning about this portion of the tax code is worth your time.

In 2018, a taxpayer sells stock for a gain. Being the savvy taxpayer that she is, she invests that gain in a Qualified Opportunity Fund, or QOF. Under the new provision, the taxpayer will get the following benefits:

- If the taxpayer makes the election, she won’t have to recognize any of the gain on her 2018 tax return. It’ll get deferred until the earlier of the date she sells her interest in the QOF or Dec. 31, 2026.

- If the taxpayer holds her investment in the QOF for five years, 10 percent of the deferred gain is permanently excluded.

- If the taxpayer holds her investment in the QOF for seven years, 15 percent of the deferred gain is permanently excluded.

- If the taxpayer holds her investment in the QOF for 10 years or longer, she doesn’t have to recognize any of the gain on the sale beyond what was previously deferred.

Let’s quantify things — if the gain invested was $200,000 and the investment was sold 10 years later for $500,000, the taxpayer ends up saving $78,540 in taxes just by choosing to invest in a QOF instead of a traditional investment* — see the math in a footnote below. You might be thinking to yourself that this is starting to sound a bit like an infomercial. I’m throwing around some outrageous claims, offering some incredible deals and putting asterisks at the end of sentences. Believe me, I get it. I had to restrain myself from saying, “But wait! There’s more!” multiple times while listing the benefits, but this isn’t a scam, and I’m not trying to sell you any shake weights. It is, however, a portion of the tax code and thus a little more complicated than my scenario makes it out to be. So I’ll explain how things work using a bit more detail.

Taxpayer

Just like life and love, this tax code doesn’t discriminate (Where are my “Hamilton” fans?). Any taxpayer that recognizes capital gain for federal income tax purposes is eligible for this incentive. This includes individuals, C corporations, partnerships, S corporations, trusts and estates, to name a few. If a pass-through entity chooses not to defer its capital gain, the owners have the option to elect the gain deferral on an individual level.

Eligible gains

We’re not talking about the gains you’ve been making in the gym lately. They need to be short-term or long-term capital gains from a sale occurring after Dec. 22, 2017, and before Jan. 1, 2027. Additionally, I know your mom is great, but you can’t generate this gain by selling your stock to her. The gains must arise from a sale of property with an unrelated person.

Invest

Once that gain has been made, it needs to be invested within 180 days. That means you get to do whatever you want with your money for six whole months — bathe in it, daisy-chain it together and wear it as a necklace, double it in Vegas. That last option is not advised, but hopefully you get the picture. On top of that, only the gain portion needs to be invested. If you sell stock for $250,000 that you bought for $200,000, you can invest the $50,000 gain and pocket the rest.

Qualified Opportunity Fund

Within the 180 days, the taxpayer needs to invest that eligible gain in a QOF. A QOF is a partnership or corporation that holds at least 90 percent of its assets in Qualified Opportunity Zone, or QOZ, property or businesses, also known as O-zones. Now, I could get extremely complicated here, but I’m your friend. We’ve spent five whole minutes together while you’ve read this article, so I’ll save you the gory details. Just know that there are a lot of rules surrounding what qualifies something as either QOZ property or a QOZ business — an important rule being that QOZ property must be either new or substantially improved.

Qualified Opportunity Zone

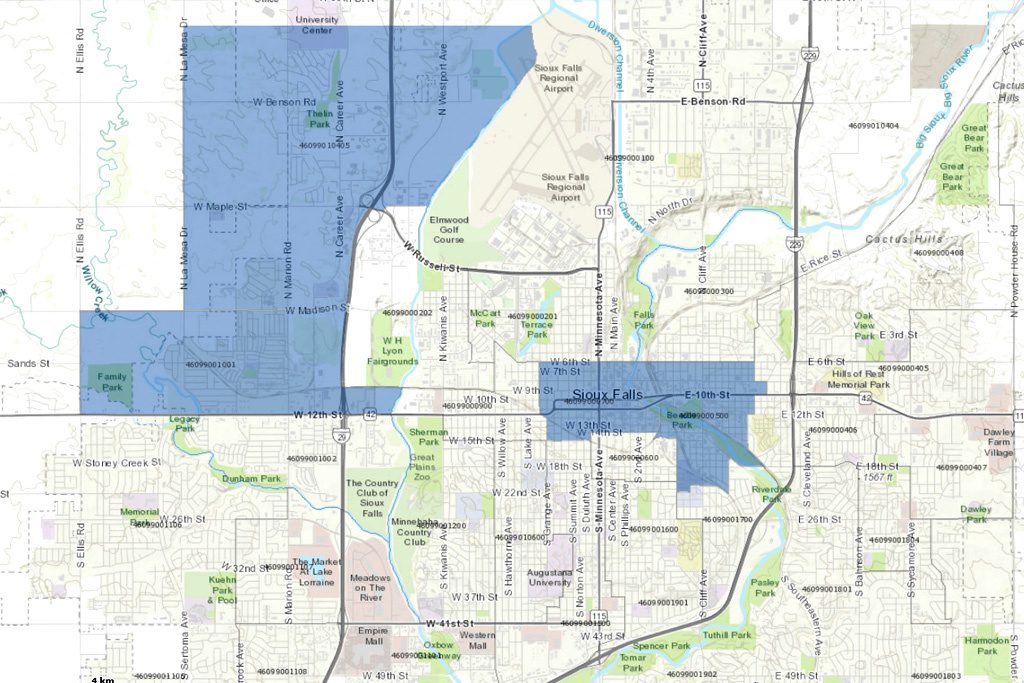

Well, I’ve somehow made it to the end of my article on QOZs without actually defining one. Hey, give me a break! I’m an accountant, not a writer. An O-zone is an area in a low-income community that has been nominated for that designation by the state and certified by the secretary of the U.S. Treasury. You can find a map of the zones here. QOZs will appear in blue or dark green.

Friends, this is just the tip of the iceberg as far as the O-zone incentive goes, but it could lead to something big, maybe even viral. Don’t miss out on being a part of it. Oh, and the tax savings start to disappear for sales after 2019, so claim your “offer” today!

* Footnote: I figured the accountants and cynical people of the world would appreciate the math behind my calculation. Assuming a 23.8 percent rate (capital gain rate plus net investment income tax), a taxpayer investing in a QOF and selling after 10 years pays tax on 85 percent of the deferred gain. In this case, $40,460 ($200,000 times 85 percent times 23.8 percent). A taxpayer investing in a traditional investment will pay $47,600 in tax on the original $200,000 gain ($200,000 times 23.8 percent) plus $71,400 ($300,000 times 23.8 percent) assuming her investment is also worth $500,000 when she sells.

For information about Qualified Opportunity Zones and Qualified Opportunity Funds, contact Blake Crow at [email protected] or 605-339-1999.