Meta to sell community bank division

Nov. 20, 2019

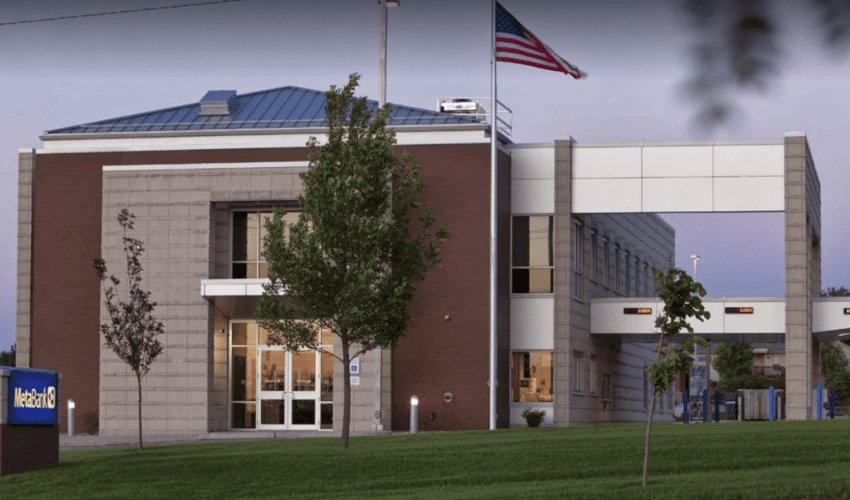

Sioux Falls-based Meta Financial Group, Inc. plans to sell its community bank division to Central Bank, which is based in Storm Lake, Iowa.

The sale includes all of Meta’s community bank branches in South Dakota and Iowa, as well as $270 million in deposits and $265 million in loans.

Following the closing of the transaction, MetaBank will retain $935 million of loans associated with MetaBank’s community bank division that will run-off over time and will be serviced by Central following the closing. The branches will be rebranded as Central Bank following the closing of the transaction.

“We are pleased to reach this agreement with Central Bank, which will allow both companies to focus on their core businesses and provide the highest level of service and value to the customers, employees and shareholders,” said Brad Hanson, president and CEO of Meta Financial Group. “This transaction aligns with Meta’s strategy to focus on improving yields from our national lending platforms, growing deposits in our payments division and improving efficiencies by streamlining operations while serving key markets often overlooked by traditional banks.”

Central has agreed to offer jobs to all current MetaBank community bank employees, including 65 in Sioux Falls. The transaction is expected to close late in the first calendar quarter of 2020.

“MetaBank employs experienced and valued bankers who represent our vision of community banking,” said John Brown, president and CFO of Central. “We look forward to working together to make a stronger community bank, bringing new opportunities to our communities, customers and employees. We are pleased to say customers can carry out banking transactions as usual.”

Meta’s roots are in Storm Lake. It was founded as Storm Lake Savings and Loan Association in 1954 by Stanley Haahr, whose grandson Tyler led Meta through a period of unprecedented growth before stepping away from the company in 2018.

Meta expanded into Sioux Falls in 2000 and has three locations in the city, as well as branches in Brookings, Des Moines and Storm Lake. Central Bank was founded in 1877 and has more than $900 million in assets.

“Central Bank’s focus of dedicating our time and resources to the communities we serve encompasses the true meaning of community banking,” said Tim Brown, chairman of the board and CEO of Central. “We look forward to accomplishing great things for our customers and employees while embracing our core values of providing exceptional service and helping our customers achieve financial success.”

Additional details and updates are expected to be sent to affected customers in the upcoming weeks. MetaBank, which issues Meta Financial’s payment cards, will continue to exist as a chartered bank but won’t have branches.

The transaction is expected to result in a pre-tax net gain to the Meta Financial of $18.5 million. The company intends to deploy capital generated from the sale into share repurchases, as appropriate, and other corporate purposes, it said in a statement.