Opportunity zones draw limited investment so far despite interest

April 1, 2019

The apartments now under construction on the southeast side of downtown are thought to be the first in Sioux Falls to take advantage of a federal tax incentive designed to spur investment in economically challenged areas.

For developer Norm Drake, building the Third Avenue Lofts has been a long and winding process that at one time involved using city tax increment financing to help build subsidized rental housing offset with federal funds.

Then, the market for tax credit housing dried up around the 2016 presidential election because of uncertainty for future deductions.

That same election led to the Tax Cuts and Jobs Act of 2017, which brought a provision that allowed the Third Avenue Lofts to finally move forward.

“So we gave back the incentives to the city and said we’ll take it on as a market-rate project,” Drake said.

Legacy Developments is partnering on the project with Nebraska-based Urban Housing Partners, which is owned by Sioux Falls native Kevin Keating.

The apartment complex, which will include 63 one-bedroom and 24 two-bedroom market-rate units, is located in an opportunity district – a distinction created along with the change in federal tax law.

Beginning in 2018, a taxpayer can sell an asset – real estate or stocks – for a gain and delay recognizing that gain if the proceeds are invested in a qualified opportunity fund.

“Nobody really knew what they were, and that led us down the path of further exploration,” Drake said.

Understanding the opportunity in qualified opportunity zones

Legacy worked with Eide Bailly LLP ito determine the Third Avenue Lofts would qualify and to structure the investment so it met regulatory requirements.

“It accomplishes two things: They were able to defer gains from an existing partnership, and they’re getting to a part of downtown where they wanted to do some construction,” said Eide Baily’s Stacy Erdmann, a partner and CPA who worked with Legacy on the project.

“If you want to be in a qualified opportunity zone, you need to make sure the project meets the specifications before you go to fund it. It is a very ‘cross your t’s and dot your i’s’ type of transaction. You have to get all the pieces set into place as you get started.”

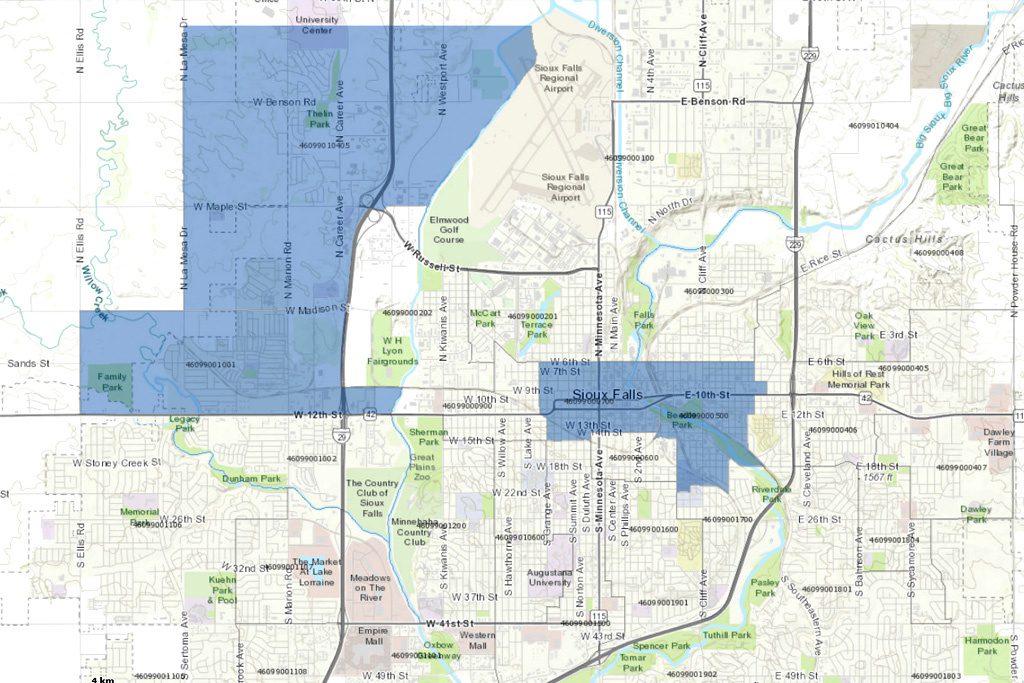

Opportunity zones were created in low-income areas after recommendations by governors were approved by the federal government. This is where they exist in Sioux Falls:

Legacy has been far from the only entity to inquire about the opportunity, said Blake Crow, a Eide Bailly CPA and tax partner who wrote this piece about the change for SiouxFalls.Business late last year.

“Following our article, I had over a dozen meetings on the topic,” he said. “I think a lot of people are interested and intrigued by it but have not gone fully to the stage that Legacy is at yet.”

Part of the holdup is that some of the federal regulations around the program are still being proposed, so there are questions about some of the nuances of the tax treatment, he said.

“So we see a lot of interest but also a wait-and-see approach, which is a double-edged sword because to get the full benefit of the law, the earlier you fund the better. Once we get out of 2019 and into 2020, you can still do it, but the tax benefits start diminishing as soon as 2020.”

The Third Avenue Lofts project funded in 2018 and started construction, demolishing a 1960s-era vacant office building in the area west of Third Avenue between 12th and 13th streets.

“I believe we were probably one of the first in the nation to deploy funds,” Drake said.

“It’s about investing capital gains into these lower-income areas of communities and redeveloping them.”

The tax benefits are significant. The gain invested in the opportunity fund doesn’t need to be recognized until the interest in the fund is sold or Dec. 31, 2026.

If the investment is held in the fund for five years, 10 percent of the deferred gain is permanently excluded. That increases to 15 percent at seven years, and if investment is held in the opportunity fund for a decade or longer, the taxpayer doesn’t need to recognize any of the gain on the sale beyond what was previously deferred.

“If you hold the project for 10 years, you, in layman’s terms, will never pay capital gains when you sell the asset. If you hold it for 15 years and sold it for twice what you bought it for, you pay no capital gains,” Drake said.

“It is unheard of.”

The Third Avenue Lofts are on track to open for residents in the spring of 2020, and Drake is considering other investments in opportunity zones.

The approach can be used in large-scale deals, such as Legacy’s, or much smaller ones, Crow said.

“I’ve also had conversations where John Doe is going to buy an investment property and happens to have Apple stock with gains that can be used for the down payment,” he said. “So it doesn’t have to be massive investors in huge developments. That’s where conversations have been on both ends of the spectrum.”

He has had multiple conversations with commercial real estate professionals who know which of their properties are in opportunity zones, he said.

“They’re certainly using it in their marketing of those properties, so I think it’s something we’ll see more and more as the regulations get finalized and people get more certainty.”

Investments in qualified opportunity zones can be made in businesses or in real estate. If they’re in real estate, they have to involve new construction or spending as much renovating the property as is spent purchasing it. It can apply to residential or commercial property.

“At the end of the day, it should be an investment you would make without the tax benefit,” Crow said. “The tax benefit shouldn’t be the tail that wags the dog.”

Investor and developer alert! Sioux Falls O-zones offer big tax incentives