SBA loans meant to help businesses lead to fraud cases for some

Feb, 8, 2021

Korena Keys’ first hint that something wasn’t right came in the mail.

“My director of operations was going through bills, and we got a letter from the SBA with a loan repayment schedule for an EIDL loan,” said Keys, founder and CEO of KeyMedia Solutions, a Sioux Falls-based digital marketing firm.

The EIDL, which stands for economic injury disaster loan, is offered through the U.S. Small Business Administration during qualifying disasters.

The loans experienced unprecedented demand during the COVID-19 pandemic because businesses could use them to help navigate through temporary loss of revenue.

Except, Keys had never applied for one.

The loan repayment schedule said otherwise.

“I figured it was some scam,” she said.

She called toll-free number associated with the program, expecting to be told the letter was fake and to disregard it.

“And they said, ‘Nope, that’s accurate. It’s your business.’ ”

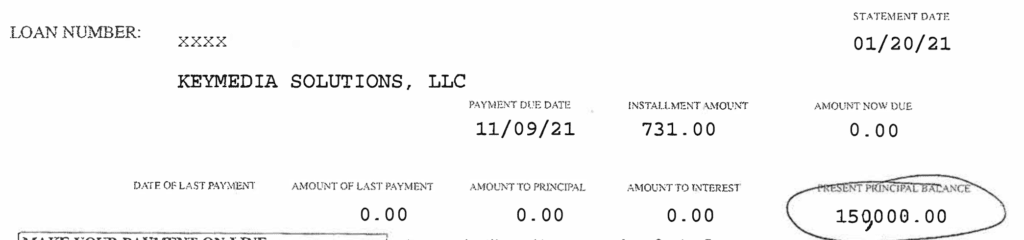

The loan included her company’s EIN, or employer identification number. And it had been funded. A major bank had OK’d the loan in November and deposited $150,000 into a bank account — a bank account that wasn’t tied to KeyMedia Solutions.

“They said, ‘This is fraud. You have to file a claim.’ ”

That’s what she did, working through the Office of the Inspector General. She’s filed a police report, a fraud report with credit bureaus and a report with the IRS.

“I’ve been assured, if we file a claim, it will take a long time to resolve, but we don’t have to pay it back,” she said.

In the meantime, she started alerting others. Keys is part of multiple peer groups, including one for CEOs in Sioux Falls and one for marketing firms nationwide.

“I said, pull your credit reports, get credit monitoring,” she said. “Then I started hearing back from so many people.”

As colleagues began to pull their credit reports, she estimates 25 percent to 30 percent found something.

“That’s a huge number, and it’s not just local to Sioux Falls,” she said.

In most cases, there had been an inquiry on the business’ credit related to the SBA loan program. But something in the application had been flagged, and loans had been denied.

“It just seems crazy,” she said. “I have two credit monitoring programs I use, and I got no dings or alerts that my credit was checked. I also have a subscription for credit monitoring and identity theft. But the SBA only checked one credit bureau, and it wasn’t the two I had.”

In South Dakota, more than 8,000 EIDL loans have been approved since spring 2020, said Jaime Wood, South Dakota district director for the U.S. Small Business Administration.

“We know the majority of them are good. I’ve been traveling across the state, and we get lots of great feedback and success for businesses who have taken out EIDL and used it with the intent it’s meant for,” she said.

The office also has been getting calls from businesses with concerns similar to KeyMedia, though it’s not at the level urban areas have experienced, she said.

Usually when a disaster is declared, a team comes out and meets with individuals one-on-one. With the pandemic, everything was done electronically, opening the door for fraud.

The SBA doesn’t believe a business that applied for or participated in the Paycheck Protection Program is at any greater risk for EIDL-related fraud, Wood said.

“Those are separate systems, and they do not talk to each other. PPP is managed through local lenders with a special system that talks to SBA,” she said.

“The EIDL is through the Department of the Treasury and applied directly through SBA. The perpetrators would have to have personal information they get from outside our system and would make an application in our system.”

In some cases, victims might have no longer been in business. In other cases, relatives of business owners have been named as applicants in fraudulent applications.

“And honestly – and people don’t like to hear this – but sometimes it’s an insider inside the businesses like a former employee or relative,” Wood said. “It’s not always domestic-type terrorists or something. And SBA already has moved forward with solving many of these cases across the nation, identifying perpetrators and holding them legally accountable, so while it seems new for South Dakota, it’s something they are regularly working on.”

And because businesses have up to a year to begin repaying an EIDL once it is awarded, cases of fraud could continue to emerge for months as those bogus loans come due.

“Each one is of utmost concern and importance, and we’re mortified and sorry this is happening and doing everything we can to make sure it gets mitigated in a timely manner and also prevent it,” Wood said.

“From last year to where we are now, our process has been greatly refined on how these loans are processed. Early on when COVID first started, it was mayhem across the nation. Businesses were shutting down because they didn’t know what to expect. Schools were shutting down. Government was trying to step in and fill the gap so our economy didn’t completely crash, and that’s when opportunists will strike in any disaster.”

As for Keys, thanks to a Freedom of Information Act request she filed, she received a copy last week of the fraudulent loan application submitted in her name.

“The financial information didn’t match up. The phone number is off by one digit. The email address was different, but it had my Social Security number, my home address, the work address, the EIN number, the years in service. It had a lot of information,” she said.

“Because of what I do, I’m not totally shocked the information is out there. We would be naive. That part is not shocking, but how did this get through without any verification of identity? That’s the part that scares me. I really think there are a lot of victims out there who don’t know they’re victims. Just the number of people who have done a credit check and found specific activity is alarming to me, which tells me there are thousands more.”

What to do

Individuals and businesses should consider requesting a credit report with multiple bureaus. If you think you could be the victim of fraud from an EIDL program, call SBA’s Office of Disaster Assistance customer service center at 1-800-659-2955 and email [email protected]. EIDL fraud claims may also be directed to SBA’s Office of Inspector General: 1-800-767-0385.