Tax reform and the family business: What you need to know

Jan. 21, 2019

This paid piece is sponsored by the Prairie Family Business Association.

Tax time will be a little different this year as changes in the law could mean critical adjustments.

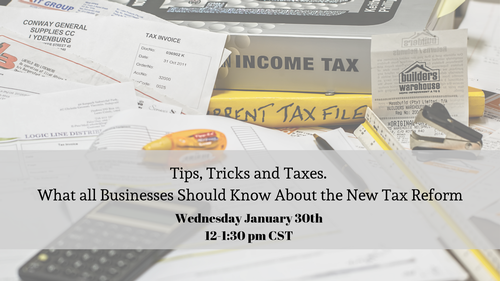

Professionals from Eide Bailly LLP will share their insight during a Jan. 30 Lunch & Learn webinar presented by the Prairie Family Business Association.

Members can watch online from noon to 1:30 p.m. or come together at a viewing location.

Eide Bailly tax partner Jim Jarding shares a preview of what to expect.

What are some of the most critical changes businesses will encounter as they prepare to file for 2018?

There are significant changes related to the tax depreciation rules, including 100 percent bonus depreciation on both new and used property and an increased Section 179 expense allowance. The Section 199A deduction will reduce the tax burden for eligible pass-through entities. This provision is intended to extend tax relief to pass-through entities that would not benefit from the lower corporate income tax rate since the pass-through entities do not pay income tax. There is also now a higher revenue threshold for companies that are required to use the accrual method of accounting.

Are there some key changes in the law that specifically apply to family businesses?

Family-owned businesses will want to learn more about changes in estate planning. There are significant opportunities because of the new unified credit amount. It may be the time to make additional gifts to utilize the increased unified credit amount or make use of generation-skipping tax funding, or GST, techniques. For taxpayers under the new unified credit amount, one may consider undoing prior gift techniques if the step-up in basis is more beneficial than the estate tax exclusion.

What are some of the biggest questions you’re receiving from businesses about the changing tax law?

The biggest questions that I am receiving right now deal with entity choice — C corporation versus S corporation, depreciation rules, structure of owner compensation and revaluation of estate planning given new unified credit amounts.

What about 2019? Are there some things family businesses should be assessing now to make sure they’re in good shape for this year?

Sales tax. With the Supreme Court decision in Wayfair, companies with an online presence now need to assess whether they have a sales tax or income tax filing requirement in other states even if they have no physical presence in that state.