Trust business swells in South Dakota with international changes

April 30, 2018

For decades, South Dakota has been among the most favorable places in the nation to establish a trust.

But the advantage now has worldwide reach.

Within the past 10 years, changes domestically and internationally have combined to make the state the site of choice for some of the world’s wealthiest to place their assets.

“South Dakota is shining,” said Antony Joffe, who began Sterling Trustees with his father in Philadelphia and based it in South Dakota in 2010.

“You’re definitely seeing a lot of foreign trust companies having interest in the U.S., and a lot of them are coming to South Dakota.”

The names are filling up small but high-end office space primarily in downtown Sioux Falls.

There’s Trident Trust Co. at 200 N. Phillips Ave., which employs 800 people worldwide serving clients on every continent and established its South Dakota trust operation in 2014.

“Our South Dakota office has quickly attracted a large number of clients both from the United States and the international high-net-worth community,” the company writes on its website.

There’s JTC, which recently leased office space downtown at Equity Square. The company has 550 employees globally, $85 billion in assets under administration and launched its U.S. trustee services in 2016.

Formerly known as Jersey Trust Co., the company provided a statement to the website International Investment after receiving its trust license in South Dakota.

In it, JTC said it chose the state “because of its trust legislation and fiscal regime, as well as the efficiency of its courts, its location in a convenient time zone and being part of one of the world’s most politically, economically and socially stable countries,” adding “South Dakota is becoming “an increasingly popular jurisdiction for private and institutional clients with U.S.-connected wealth planning requirements.”

And then there’s CISA Trust Co., established in 1972 in Switzerland. Its U.S. trust office was established in South Dakota in 2016. It’s a neighbor of JTC in downtown Sioux Falls, with an office finishing construction at Equity Square.

“From all of the states in the union, we picked South Dakota because the state consistently ranks as one of the best trust jurisdictions in the nation. South Dakota is very pro-business and we believe, for our industry, it provides us a unique niche for international trusts,” said Anthony Botticella, managing director.

“We chose Sioux Falls for our office location because it is unquestionably the business and financial capital of South Dakota and has a highly educated workforce with expertise in trust administration.”

His office has three staff members but is “actively looking to hire more trust officers as we continue to grow.”

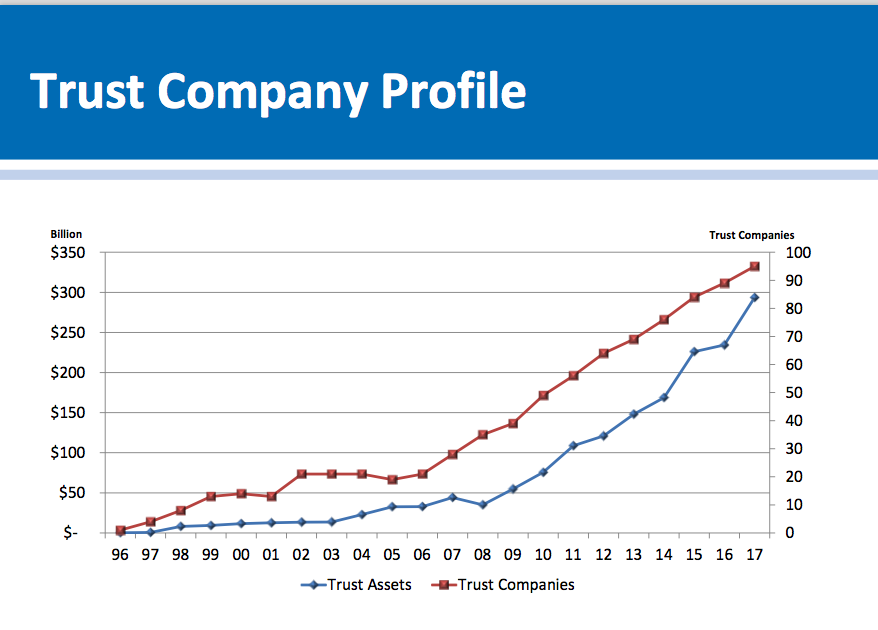

Trident, JTC and CISA are three of about 95 trust companies licensed to do business in South Dakota — a number that has steadily increased in recent years — and nine trust departments. Seven new companies were established last year and two so far this year. A clarification in state law defining what constitutes having an office here is further bolstering leasing activity for trust companies, state officials said.

Existing companies, such as South Dakota Trust Co., are seeing more demand for their services too.

“The numbers speak for themselves,” said Matt Tobin, chief operating officer and managing director.

“Domestically, South Dakota continues to be a leader in the trust industry, and the state’s trust laws are at the top. And the U.S. is now viewed as the leading jurisdiction (globally), and so you continue to see more and more international families and businesses looking to the U.S., and once they look to the U.S., some of that business continues to come to South Dakota.”

Changing laws prompt expansion

The world’s elite used to have more options for housing their assets with a degree of privacy, as places from the Cayman Islands to Switzerland gained notoriety. But, led by the U.S. in the past decade, the world began asking for more disclosures.

That led to the Common Reporting Standard, which requires participating nations to disclose assets housed in one country to a client’s home country. The U.S. began requiring such disclosures years earlier.

“It’s really a way to root out tax evasion,” Joffe said. “It’s a good thing, and the U.S. has really been at the forefront.”

The U.S., though, has not signed on to an across-the-board global agreement, negotiating individually with nations instead.

“The U.S. has become a more favored jurisdiction versus a Switzerland because we have a much more stable regulatory environment,” Joffe said. “People look at the U.S. as a good place to be.”

And that often leads them to South Dakota, where the same factors that have led to trust growth domestically are attractive to international clients.

The requirements to become established as a trust office are not at rigorous as other states, and capital and startup costs often are lower, said Jessica Beavers, senior vice present of Sawmill Trust Co., which became a state-chartered trust company in 2004 and recently opened an office at 222 S. Main Ave.

Sawmill’s office has space for eight trust officers and has grown from its roots in Minnesota to work with many multigenerational family clients with $25 million or more in assets.

“Our clients come for a variety of reasons,” she said, noting the state’s directed trust and privacy statutes.

The international financial world began taking notice a couple of years ago. The Financial Times ran an article with the headline asking if South Dakota was “the new Switzerland,” noting its jump in assets housed in the state and its benefits: “no personal or corporate income tax, no limit on ‘dynasty trusts’ and strong asset protection laws.”

The article cites well-known U.S. families, from the Wrigleys to the Carlsons, former owners of the Radisson hotel chain, whose trust assets have long been held in the state.

Many of them have relationships with South Dakota Trust Co., which has more than $45 billion in assets under administration and works with more than 90 billionaire clients. It acts as both its own trust company and provides space and services to private family trust companies that are required to have physical offices in the state.

South Dakota Trust is keeping its office at 201 S. Phillips Ave. and expanding to the first floor of 212 S. Main Ave. and part of the second floor.

“We’re not busting at the seams, but we’re approaching the point where we would be full, so this is a move looking ahead that gives us room to grow both our core personal trust business as well as our private trust company business,” Tobin said. “We’re managing the growth of the business from both sides.”

The new office will have room for more than 20 family trust companies, and staff members are expected to start moving in this summer.

Changing international rules have had a modest effect on his company’s growth, Tobin said. While the company works with international clients, they usually have a personal or business connection to the U.S.

It has bolstered the overall industry, though, he said, as international clients realize “if I’m going to report all this, I might as well be in the U.S. in a stable country with sound laws and a sound economic system and have the security of the U.S. legal and financial system … and it does provide a degree of confidentiality.”

The state’s privacy laws at times have been misconstrued in the intent behind their secrecy, Joffe added.

He gives an example of a client choosing not to disclose to a child at 18 that the child is the beneficiary of a large trust and waiting instead until a later age.

“That can be a great way to stifle their ambition,” he said. “What’s unique about South Dakota is the silence of that. Whoever creates the trust can say kids don’t find out about the trust until they’re 35 and they’ve become functioning members of society. That’s a lot different from secrecy. It’s to protect the beneficiaries from themselves. There’s no tax evasion. It’s what people perceive as secrecy versus privacy.”

Workforce needs

The growth in trust companies is driving a need for more people to work in the industry.

It prompted Beavers and Joffe to become founding members of the South Dakota Trust Association three years ago, a group that has grown to almost 30 trust company members.

“I think it will just grow stronger and better,” Joffe said. “We’ve encouraged our members to provide internships, and we’ve been actively recruiting interns, but it’s a slow process. We’re slowly getting there.”

The group is reaching out to area universities to collaborate on education and training.

“It’s a great opportunity for graduates,” Joffe said. “They’re high-paying jobs. You have to bring a lot of skill sets to the table, so you don’t get pigeon-holed in one area.”

Those include a legal, tax and accounting background plus communication skills.

“You become a psychotherapist to some clients as well,” he said, only half-joking. “It’s the nature of the business.”

There is a lack of trust officers in the state, Beavers added, as many jump from company to company.

“It’s kind of this quiet unknown. There are jobs open,” she said. “We are putting together a curriculum for students in our state to address the need.”

The South Dakota Legislature routinely reviews trust laws and makes changes designed to keep the state a desirable location, many in the industry said.

“The industry continues to grow,” Tobin said. “The direct benefits to the state are quantified in jobs, payment of bank franchise tax to the general fund; there are a lot of benefits.”

Botticella at CISA notes that some of his employees sit on local charitable boards and said his firm is “dedicated to help in the community and to being a good corporate citizen.”

“Being located downtown provides us great exposure with many business located here. It has become a trust office hub, and we really feel like we are part of the trust community with the law firms and trust offices in the downtown loop.”

It’s a community that seems destined to get bigger.