With global volatility, Sioux Falls CEOs report some softening business conditions, expectations

April 11, 2022

Sioux Falls CEOs are more optimistic about conditions in their business than they were three months ago, according to the most recent SiouxFalls.Business CEO survey.

SiouxFalls.Business conducts the quarterly survey in conjunction with the Augustana Research Institute.

The latest survey was conducted during late March and completed by 79 CEOs and business owners, whose “collective exuberance about the future is somewhat muted from last quarter but remains high,” said Reynold Nesiba, a professor of economics at Augustana University.

“These views are consistent with national data showing strong economic growth, low unemployment, rising inflation and increasing interest rates. Concerns about the political economic ramifications of the Russian war in Ukraine, ongoing supply chain disruptions and higher fuel prices are dampening the positive effect that federal stimulus dollars, higher sales, lower unemployment and falling COVID-19 infection rates would otherwise yield.”

It appears U.S. and local economies are continuing to expand after the two-month COVID-19 recession that officially ended in April 2020, he added.

“Increased access to vaccinations and boosters, combined with falling rates of infections and substantial increases in federal government spending, have spurred increases in consumer spending, sentiment and sales. Businesses have responded to rising demand by increasing production, investment — particularly in residential housing and inventories — and employment. The result has been growing incomes, economic growth, increases in prices and well-founded grounds for optimism about the future of this fine city on the edge of the northern Great Plains.”

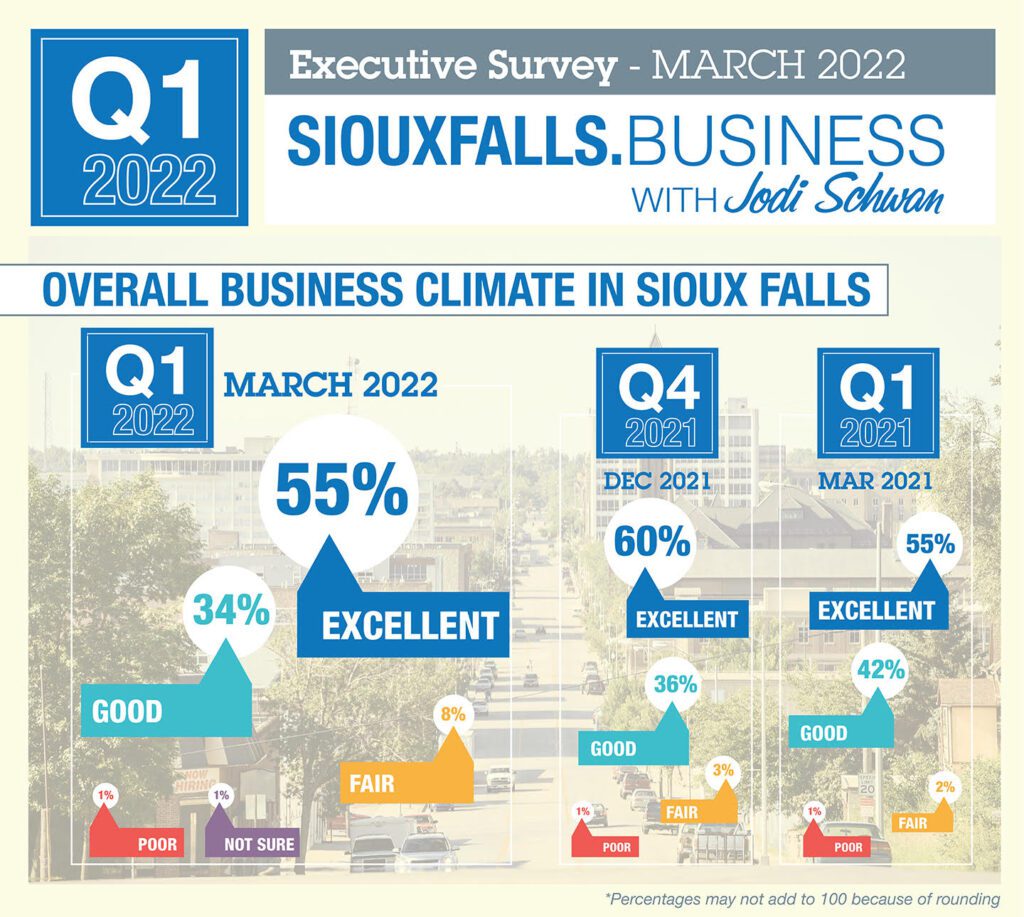

Overall, CEOs reported conditions at their businesses were essentially as strong as the prior quarter, with 92 percent reporting they’re good or excellent, compared with 94 percent three months prior.

In the past quarter, about one in four reported a significant increase in sales, compared with 35 percent in the three months prior. But 12 percent reported a slight or significant decrease, compared with 5 percent three months ago.

Statewide sales tax revenue increased 16.5 percent in March, compared with a year ago, Nesiba, noted. That represented February sales.

“The national data and analysis from The Conference Board are broadly consistent, if slightly less optimistic, than our sample from Sioux Falls. At the national level, the Consumer Confidence Index was up slightly in March after decreases in January and February. The Conference Board’s Present Situation Index also rose,” Nesiba said.

“This reflects improving sentiments about business conditions and the labor market. In contrast, their Expectations Index fell. This suggests pessimism about the future, particularly with respect to expected future income. The concerns at the national level about the war in Ukraine, rising interest rates and higher prices — particularly at the gas pump — have also dampened automobile sales. At the same time, a strong national labor market has lifted consumer sentiment, despite concerns about rising prices.”

Price increases might be playing a factor in Sioux Falls as 76 percent of CEOs reported a slight or significant increase, compared with 69 percent three months ago.

These reports of higher prices in the survey are consistent with national data on prices, Nesiba said. According to the March 10 report from the Bureau of Labor Statistics, over the last 12 months the Consumer Price Index rose 7.9 percent.

“Higher prices have been driven particularly by increases in energy-related costs — specifically gasoline — as well as increases in food and shelter prices,” Nesiba said. “Other areas contributing to rising prices include increases in prices associated with recreation, household furnishings and operations, motor vehicle insurance, personal care and airline fares. If one removes the most volatile food and energy prices, core inflation in the U.S. rose 6.4 percent in the last 12 months.”

The U.S. is not alone in facing higher prices, he added. According to Jongrim Ha, M. Ayhan Kose and Franziska Ohnsorge writing for the Brookings Institution on April 5, global inflation has risen sharply since late in 2020 to over 6 percent.

They attribute this global change to several factors, including “unprecedented policy support for inflation, the release of pent-up demand, persistent supply disruptions and surging commodity prices.”

“The commodity price surge triggered by Russia’s invasion of Ukraine last month is adding to these price pressures,” Nesiba said. “U.S. inflation is also a product of these same global supply chain disruptions, spikes in energy costs and the commodity price shocks related to the unprovoked Russian invasion of Ukraine. Core U.S. inflation is above the global level in part because of the more aggressive federal fiscal action taken by the U.S. This has succeeded in creating a V-shaped recovery with rising consumer spending, investment, overall GDP growth and employment. The risk of mild inflation seems less destructive to the overall economy and better for both businesses and workers than the slow growth and persistent unemployment that characterized the recovery after the 2007-09 recession.”

Hiring in Sioux Falls in the first quarter appears more or less on par with the previous quarter, with 65 percent reporting a slight or significant increase in hiring, compared with 64 percent three months ago.

Survey results also are provided to the Sioux Falls Development Foundation and the Federal Reserve Bank of Minneapolis to assist in their understanding of area business conditions.

“Overall business conditions still seem to be quite positive – sales activity, hiring demand, capital expenditures – all check the ‘growth’ box that you hope for,” said Ron Wirtz, regional outreach director for the Minneapolis Fed.

“If I’m going to nitpick, while sales activity was very healthy, it fell very modestly from very high levels in preceding surveys. Probably something to keep an eye on. But future expectations were also really strong, so they didn’t tip their hand much if there was any nervousness.”

Looking ahead

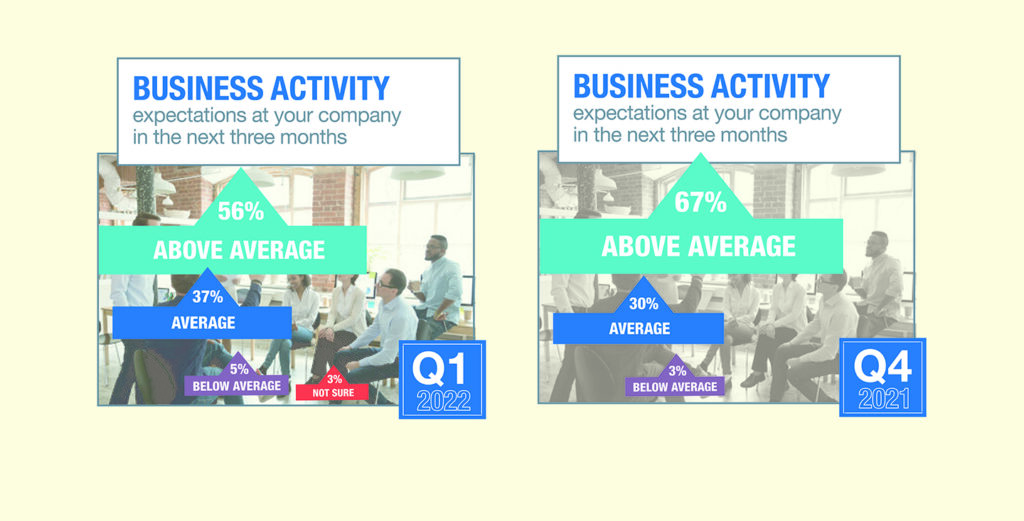

When asked to project their expectations for the coming quarter, CEOs show they’re tempering. More than half still said they expect above-average business activity, but that compared with two-thirds in the previous quarter.

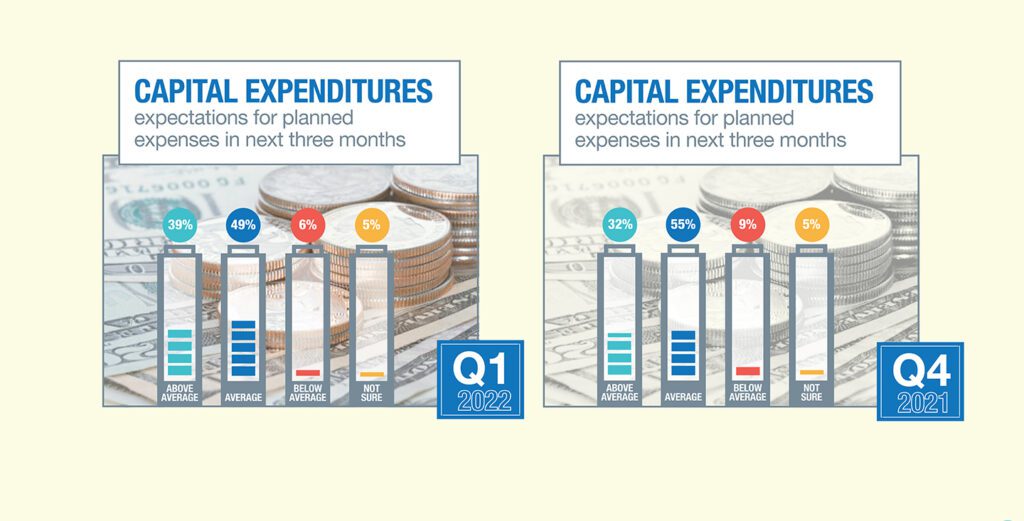

In projecting capital expenditures, 88 percent expect average or above-average spending, compared with 87 percent in the prior quarter.

Survey results around capital spending are consistent with data from the Bureau of Economic Analysis, particularly the increases in investment reflected in its most recent report, Nesiba said. The latest data on GDP growth is from the final quarter of 2021 when growth increased to a 6.9 percent annual rate. That’s up from 2.3 percent in the third quarter.

“This was fueled by increases in inventories and residential investment, as well as increases in exports and consumer spending,” Nesiba said.

And in hiring, 82 percent of CEOs in the Sioux Falls area expect average or above-average hiring, compared with 87 percent in the previous quarter.

Business climate comparison

Nearly nine in 10 CEOs rate the overall business climate in Sioux Falls as good or excellent, which is somewhat weaker than the 96 percent that said the same three months ago.

“Part of this optimism about the local business climate is powered by unprecedented levels of federal, state and other spending in and around Sioux Falls,” Nesiba suggested. “During this last legislative session, several special appropriations bills passed that will fund at least $99.5 million in major construction and/or economic development projects.”

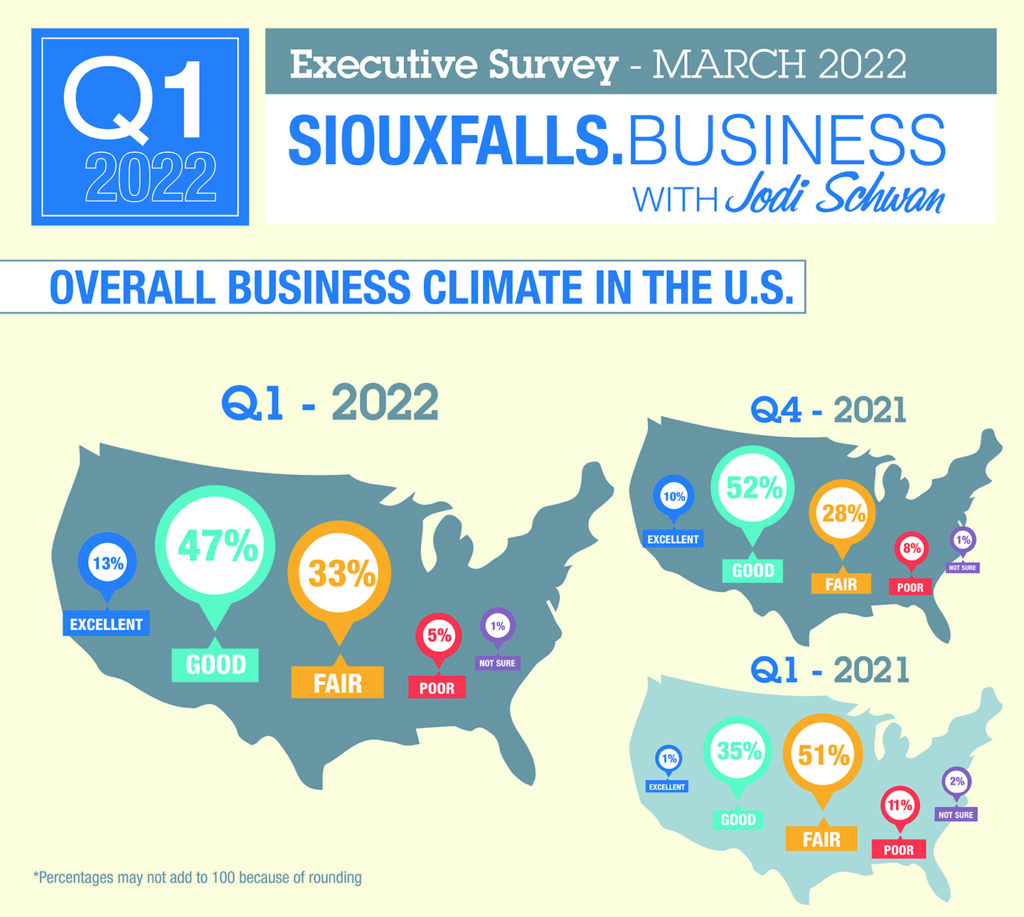

CEOs’ impressions of the U.S. economy showed an even more noticeable drop, with 60 percent rating it good or excellent compared with 62 percent three months ago.

“Perhaps some of that tempering of enthusiasm reflects broader economic currents, Russia’s attack on Ukraine, ongoing supply chain issues, the Fed’s raising of interest rates, workforce challenges and 7.9 percent inflation has created political economic concerns globally, nationally and locally,” Nesiba said.

Overall, Wirtz at the Fed said he’s seeing a story emerge in the data his organization tracks from businesses across the Ninth District, including in South Dakota.

“Via recent surveys, construction firms have told us activity is pretty good and the pipeline of future projects also healthy; many hospitality and tourism firms are doing well, especially those capitalizing on the great outdoors,” he said.

“This is both reassuring and surprising given the multitude of challenges that businesses face today. I don’t know when I’ve seen such a confluence of challenges – tight labor markets, rising prices and supply chain disruptions have been a problem for some time. Now add international conflict to the mix and rising interest rates more recently. At the end of the day, I guess it’s probably more worth all of the headaches when at least you’re still making a buck as many firms still seem to be doing. Not everyone, of course, but many, and that’s really encouraging for the economy. I think it’s a good reminder of just how resilient businesses are in the U.S. economy.”

And while the underlaying data seems healthy across the district, “It sure seems that Sioux Falls is getting an extra helping, at least in certain sectors,” Wirtz said, pointing to the first quarter’s building permit total, which “beat the pants off last year, which I think was a record, which beat the year before by a mile. Point is, investment in Sioux Falls is really strong – as evidenced in the 80-plus percent that have either average or above-average plans for capital spending – and there might be no greater confidence indicator than that because you don’t build a new house or a new office or retail or industrial space without having some confidence that you’ll have the future income to pay for it.”

Sioux Falls Development Foundation resources

Do you have further information to share about conditions at your business? Or are you looking to connect to additional resources to support your growth? The Sioux Falls Development Foundation can assist you in the following areas:

- Workforce development: The Development Foundation offers programs and initiatives to help you attract, retain and develop your workforce. Contact Denise Guzzetta, vice president of talent and workforce development, at 605-274-0475 or [email protected].

- Business growth and expansion: Whether your business is planning an expansion in the next five years or facing risk factors impacting growth, the Development Foundation can help by discussing existing building space, available land, potential local and state incentives and other resources. Contact Mike Gray, director of business expansion and retention, at 605-274-0471 or [email protected].