With stake in local fashion tech company, angel investors’ second fund is fully invested

Aug. 9, 2021

Brigit Blote and her co-founders had pitched their business too many times to count, but never quite like this.

Instead of practice or prize money on the line, the USD students and recent graduates were pitching their company, Fomeno, to Falls Angel Fund investors.

The ask: $150,000.

“This was the real deal,” said Blote, who founded the online thrift shopping business with her fellow students Ashlynn Atwood and Payton Ritz and went on to win a $100,000 Hult prize for entrepreneurship.

“It was a really great experience,” Blote said of the pitch. “I was kind of nervous going into it because I knew it was a male-dominated room, and we were pitching a female tech company. So I just wasn’t sure what they would think about it. It was funny pitching a fashion tech company, but they were so receptive.”

Forty-five minutes and many questions later, the Fomeno team left the room, and the Falls Angel team decided to make the investment.

“There’s a lot to love,” said Matt Paulson, chairman of Falls Angel Fund.

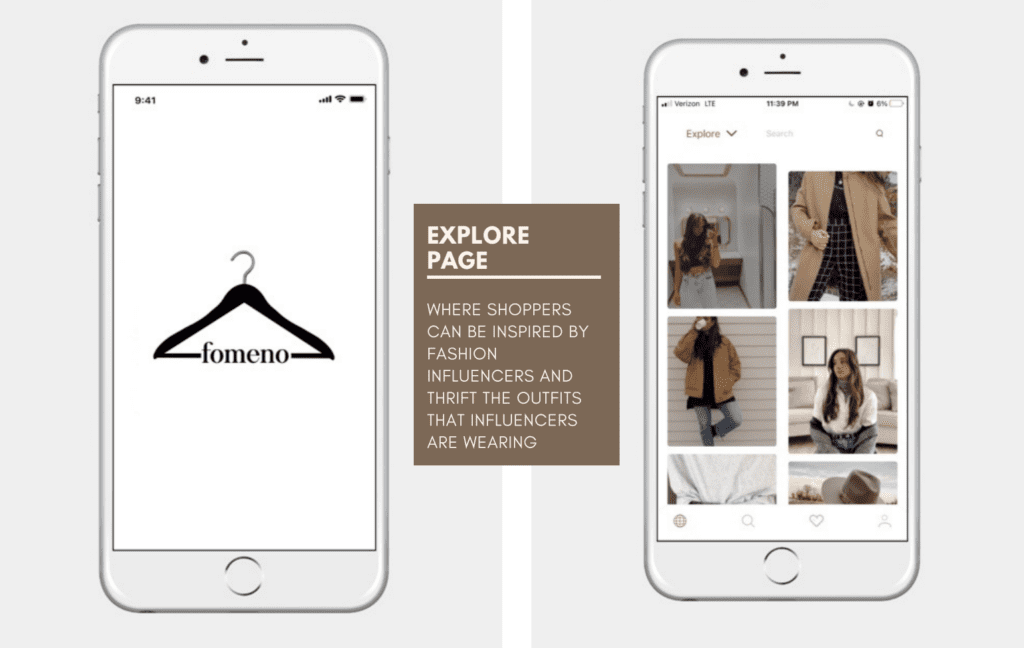

“They have a unique mobile app that has the opportunity to make a big impact in the thrift clothing market. Most importantly, they are putting in the work they need to be successful. Their startup is early, and they have a long road ahead of them, but we are rooting for them and helping them however we can.”

Bolstering startups such as Fomeno is the reason Falls Angel Fund exists. It’s one of few local sources of private equity from so-called “angels,” who invest in early-stage companies.

The fund invests in high-growth, technology-driven companies in South Dakota and surrounding states.

“We look for companies that have demonstrated traction — sales, business development or intellectual property — and are operated by founders that have a unique understanding of their industry and are willing to put in the work to make their startup succeed,” Paulson said.

“Companies we invest in should be looking to get acquired or go public in the next five to 10 years. We do not invest in retailers, restauranteurs and real estate because those opportunities do not fit our model.”

Its second fund, which launched in early 2019, is now fully invested, with equity in the following companies:

- Cytotheryx – Based out of Rochester, Minnesota, this company is using technology out of Mayo Clinic to grow human liver cells, or hepatocytes, inside of immunocompromised pigs. The cells they produce will be used for research purposes initially and could be used eventually to help heal damaged human livers.

- Omnia Fishing – Based out of Golden Valley, Minnesota, Omnia Fishing is an e-commerce website for fishing equipment. It has had strong sales growth, and the fund is optimistic about the company’s prospects.

- JourneyTellr – Based out of Minneapolis, JourneyTellr is an employee engagement platform that encourages employees to capture and share meaningful workplace experiences.

- Trigger Interactive – Based out of Brookings, Trigger Interactive provides an interactive target shooting platform for competitive shooters.

- Bushel – Based out of Fargo, Bushel is an agricultural technology firm that offers a suite of technology solutions to grain facilities. Falls Angel Fund 1 invested in it, and Falls Angel had the opportunity to make a pro-rata investment in the company earlier this year through its second fund. More than 2,000 grain facilities across the country are using Bushel’s technology.

- Prismatic – Based out of Sioux Falls, Prismatic is an enterprise software company that provides an integration platform that helps B2B software companies’ platforms talk to each other.

- WalkWise – Based out of Fargo, WalkWise is a smart walker attachment that provides families and caregivers with the tools to know that their senior loved one is doing OK.

Falls Angel Fund and its sister funds in Aberdeen, Brookings and Rapid City provide a unique network for high-growth companies to receive that first investment check, Paulson said. To date, Falls Angel Fund has invested more than $5 million in equity in the region.

“Our neighboring states do not have a network of angel funds like South Dakota does, making it easier to raise money here than in other states in our region,” Paulson said.

“We have many North Dakota companies looking to our network for angel capital because there are currently no angel funds in North Dakota. It’s not easy for any startup company to raise money in the region, but it’s definitely easier in South Dakota than it is in other parts of the northern Plains.”

The funding will help Fomeno expand its technology team, pay the founders small stipends and invest heavily in marketing mainly through fashion influencers in preparing for fully launching.

An arrangement with Plato’s Closet is allowing Fomeno access to inventory across the chain’s 400-store footprint.

“Not all their brick and mortars have online inventory, but many do, and post-COVID they’re pivoting to that online marketplace, so we got in touch with their team,” Blote said. “We’re just partnering with thrift shops to get their inventory into Fomeno’s database, so we can connect it directly to shoppers using our app because we facilitate that process of finding products in online thrift shops.”

The founders are pursuing building the business as a full-time job, and early investment support was critical, she said.

“We’re just very grateful for the people who believe in us and believe we can make Fomeno happen,” Blote said. “We’re in hustle mode. We have the tools necessary to get everything going. We’re just putting in the work to get to the point we can launch it.”

Falls Angel Fund wants to hear from high-growth startups looking to raise money, Paulson added.

While federal regulations preclude talking much about future investment plans, “there’s certainly more to come,” he said.

“We continue to actively meet with companies and look for investment opportunities. We can’t fund every deal, but we can fund the right deals.”

Paulson: Sioux Falls’ startup ecosystem is stronger than ever. Here’s why